Similar Posts

Transforming Regulator-Institution Dynamics: The Impact of Machine-Readable Regulations

Machine-readable regulations are poised to transform compliance, according to Emil Kongelys, CTO of Muinmos. He advocates for a unified protocol to standardize regulatory frameworks, enhancing clarity and efficiency. While digitization is ongoing, inadequate IT infrastructure remains a challenge. Trust in AI-driven compliance systems hinges on explainability, despite difficulties with generative AI. Real-time data sharing could redefine accountability, necessitating a common protocol. Mark Shead from Regnology emphasizes that automation can lower compliance costs, while standardized data is crucial for effectiveness. Overcoming legacy system challenges and ensuring reliable data will be vital for mainstream adoption of machine-readable regulations.

Revolutionizing Finance: How AI Transforms Customer Lifecycle Management for Unmatched Efficiency

Managing Customer Lifecycle Management (CLM) has become crucial for financial institutions (FIs) facing challenges like regulatory pressures, competition, and evolving customer expectations. Issues include rising compliance costs, inefficient onboarding processes, and the need for technological adaptation. Effective CLM, covering client acquisition to ongoing interactions, ensures regulatory compliance, enhances retention, and drives profitability. FIs must modernize their CLM strategies through automation, AI-driven analytics, and data integration. Successful examples include Santander and Metro Bank, which improved efficiency through digitalization. As 2025 approaches, strategic investments in technology are essential for FIs to thrive in a competitive landscape.

Latin America’s Mendel Raises $35M Series B to Revolutionize AI-Powered Spend Management

Mendel, a top enterprise spend management platform in Latin America, has raised $35 million in a Series B funding round led by Base10 Partners, with contributions from PayPal Ventures and other investors. This funding will help Mendel enhance its AI-driven capabilities and expand into Chile, Colombia, Peru, and Brazil by 2026. The company uses a software-first model to help businesses manage expenses and travel efficiently, focusing on recurring SaaS fees rather than interchange revenue. With a strong presence in Mexico and Argentina, Mendel serves major clients like Mercado Libre and McDonald’s, aiming to revolutionize financial management in the region.

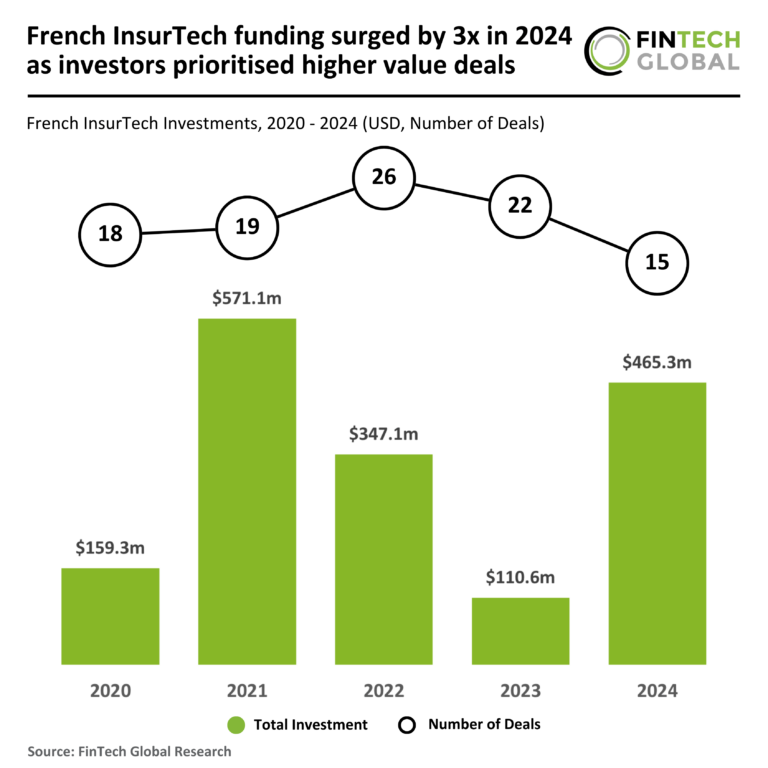

French InsurTech Funding Soars 300% in 2024: Investors Focus on High-Value Opportunities

In 2024, the French InsurTech sector is witnessing a remarkable transformation, with funding skyrocketing to $465 million, a tripling from $111 million in 2023. Although the number of deals has decreased by 32% to 15, the average deal size has surged to $31 million, indicating a strategic shift towards larger investments in established firms. This trend reflects growing investor confidence, particularly in companies like Alan, which raised $193 million in its Series F funding round, the largest for the sector this year. Alan aims to enhance healthcare through automated claims and various digital health services, poised for significant growth.

Mastercard Unveils Accelerator Program to Empower U.S. Middle-Market Businesses

Mastercard has launched the Mastercard Mid-Market Accelerator, a solution suite designed to enhance services for middle-market businesses in the U.S., with plans for global expansion. This initiative addresses the needs of companies with revenues between $10 million and $100 million, which often lack comprehensive financial visibility. The Accelerator features customizable digital payment solutions, including a new business card, cash flow management tools powered by Trovata, and expense management via Navan. Key partnerships with industry leaders aim to provide tailored solutions that support growth. Mastercard emphasizes its commitment to empowering commerce across all business sizes.

SplxAI Raises $7M in Seed Funding to Enhance Agentic AI Security Solutions

SplxAI, a leader in offensive security for Agentic AI, has successfully closed a $7 million seed funding round led by LAUNCHub Ventures, with contributions from Rain Capital and others. This funding will enhance its AI security platform, which features automated testing, dynamic remediation, and continuous monitoring. Key leadership changes include Stan Sirakov joining the Board and Sandy Dunn as Chief Information Security Officer. SplxAI aims to accelerate platform development and broaden capabilities to address the unique security challenges posed by AI. The company is committed to continuous innovation, positioning itself to manage the risks associated with AI adoption.