Similar Posts

ECB’s Lane Advocates for Digital Euro to Challenge US Payment Giants

Europe is poised to launch a digital euro to enhance its financial autonomy and reduce reliance on US payment systems amid rising geopolitical tensions. Philip Lane, the Chief Economist of the European Central Bank (ECB), emphasized the urgency of this initiative at a recent conference, highlighting the dominance of US companies like Visa and Mastercard in Europe’s payment landscape. Preparations for the digital euro have been extensive, with lawmakers expected to decide on its rollout by year-end. Lane also raised concerns about stablecoins potentially undermining traditional finance and monetary sovereignty. The digital euro aims to bolster economic resilience and maintain Europe’s presence in the global financial arena.

MuchBetter Unveils Prepaid Corporate Mastercard: Revolutionizing Business Expense Management

MuchBetter has launched the MuchBetter Prepaid Corporate Mastercard, aimed at improving corporate expense management for scaleups, FinTechs, and global enterprises. This initiative enhances their B2B services and marks a shift towards comprehensive financial solutions. Key features include instant virtual cards, customizable controls, real-time tracking via a mobile app, and seamless integration with accounting systems. The card integrates with MuchBetter Business’s Accounts banking platform, offering multi-currency accounts with lower fees. A partnership with Living Sky, a white-label platform, will leverage the Corporate Card for premium banking services. MuchBetter aims to provide a consumer-grade experience in business banking.

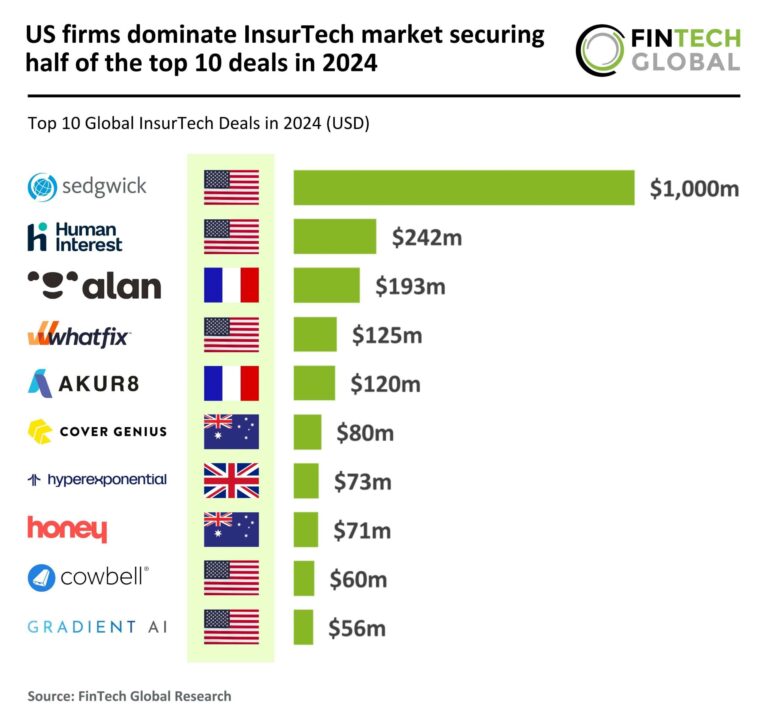

US InsurTech Powerhouses Lead the Market: Securing 50% of Top 10 Deals in 2024

In 2024, the InsurTech market faced a significant funding decline, with global investments dropping 35% year-over-year to $5 billion, and deal count plummeting to 206 from 609 in 2020. U.S. firms led the sector with five of the top ten funding deals, while Australia and France secured two each. The UK saw a decrease, and emerging markets like Singapore and India were absent from the top rankings. Notably, French InsurTech Alan raised $193 million in Series F funding, expanding its health insurance offerings and enhancing its position in the market, particularly through partnerships with Belfius Bank.

KPMG Ties Executive Compensation to Sustainability Goals Across Global Corporations

A KPMG International study reveals a significant trend in corporate governance, with 78% of major firms linking executive compensation to sustainability metrics. The report evaluated 375 publicly listed companies across 15 countries, showing that 88% align sustainability goals with remuneration strategies, focusing on climate change and workforce issues. European Union companies lead in adopting these practices, followed by the UK and Australia. Investors are increasingly seeking a balance between short-term and long-term sustainability objectives. KPMG’s Nadine-Lan Hönighaus emphasizes the importance of transparent, measurable sustainability targets in executive pay schemes to enhance corporate sustainability efforts.

South Korea Halts ESG Reporting Amid Regulatory Easing: What It Means for Investors

South Korea’s Financial Services Commission (FSC) has delayed its ESG disclosure roadmap, reflecting the evolving global regulatory landscape and calls for harmonization in ESG practices. This announcement was made during a meeting of the ESG Finance Promotion Task Force, established to enhance ESG disclosure policies. FSC Vice Chairman Kim So-young highlighted shifts in global regulations, including the European Commission’s easing of sustainability rules and Japan’s phased approach for large-cap firms. Consequently, South Korea’s ESG disclosures for KOSPI-listed companies with over 2 trillion won in assets have been postponed to after 2026, with further delays possible.

Navigating the Future: BIS Empowers Central Banks to Balance AI Innovation and Risk Management

The Bank for International Settlements (BIS) report highlights the growing significance of artificial intelligence (AI) in central banking, urging a balance between innovation and risk management. It recommends that central banks form interdisciplinary AI committees to ensure ethical integration of AI. Key strategies include conducting thorough risk assessments and updating governance frameworks to address AI-specific challenges. The BIS emphasizes the need for modernized governance structures to adapt to technological advancements, allowing central banks to improve service delivery and policy implementation while maintaining financial system integrity. For more insights, refer to the ABA Banking Journal.