Similar Posts

EBA Unveils New ESG Guidelines: Paving the Way for a Sustainable Financial Future

The European Banking Authority (EBA) has released new guidelines to enhance ESG risk management in the financial sector, aligning with key EU regulations such as CRD6, CSDDD, and CSRD. These guidelines address the urgent need for financial institutions to manage ESG risks, which threaten sustainability and climate goals. Key components include compliance requirements, transparency in reporting, and strategies for identifying ESG risks. Institutions must comply by January 11, 2026, with smaller entities given until January 11, 2027. This initiative marks a significant step towards integrating sustainability into financial practices, promoting accountability and risk mitigation across Europe.

Hexa Secures €29M in European Bank Financing to Fuel Startup Growth and Expansion

Hexa has secured €29 million in funding through a financing agreement with four European banks, including Belfius and BNP Paribas Fortis. This revolving credit facility follows a successful €35 million equity raise in 2024 and aims to enhance Hexa’s startup initiatives. Established in 2011, Hexa has launched 50 companies and introduced 10 new startups in 2024, raising €70 million from notable investors. With the new funds, Hexa plans to accelerate operations and aims to launch 13 new ventures in 2025, targeting 30 startups annually by 2030.

Streamline Climate Disclosure: EFRAG and CDP Launch Innovative Mapping Tool

EFRAG and CDP have launched a new mapping tool to enhance climate disclosure compliance, unveiled at COP29. This tool aligns with the European Sustainability Reporting Standards (ESRS) E1 and CDP’s question bank, simplifying climate reporting for businesses by addressing transition plans, mitigation targets, and emissions reporting. It offers improved compliance, better data utilization, and increased reporting efficiency. CDP CEO Sherry Madera emphasized its practical implications, while EFRAG’s Patrick de Cambourg highlighted its importance in navigating climate disclosures. This collaboration is a significant step toward improving sustainability reporting globally, benefiting companies aiming for ESRS alignment.

Will ESG Investing Decline in 2025? Insights on the Future of Sustainable Finance

ESG investing has gained traction but is facing a shift as governments reassess their ESG initiatives. Experts predict that only a few countries will lead in ESG by 2025, with the U.S. experiencing challenges due to political resistance, while the EU upholds strong ESG principles. In Asia, progress varies across regions. Recent changes in U.S. government leadership have led major banks to withdraw from ESG alliances, reflecting anti-ESG sentiments. Investor interest is declining due to transparency issues and regulatory pressures. To revitalize ESG investing, industry leaders advocate for innovation, transparency, and simplified compliance to restore confidence and focus on sustainability.

Unlocking the Future: FINRA 2025 Report Highlights Key Compliance Challenges and AI Integration in FinTech

FINRA has released its 2025 Regulatory Oversight Report, providing crucial guidance for member firms to enhance compliance programs. The report reflects FINRA’s commitment to transparency and includes key observations from its regulatory efforts. Highlights include insights on third-party risk, updated cybersecurity guidelines, and improved public communications, alongside enhanced compliance guidance for complex financial products. The report emphasizes the importance of continuous market monitoring and transparency in regulatory practices. It serves as a vital resource for firms to assess supervisory procedures and adapt to the evolving regulatory landscape, ultimately supporting investor protection and market integrity. For more details, visit the FINRA website.

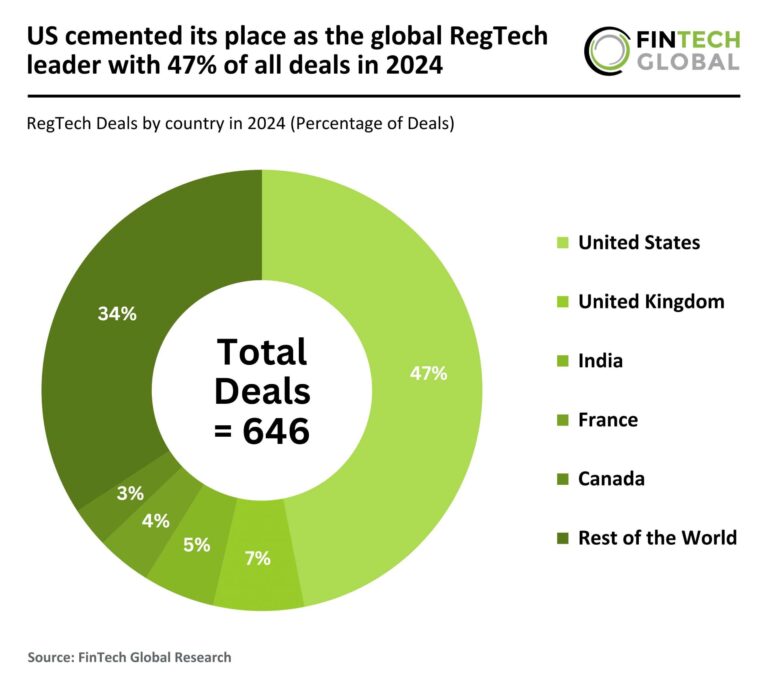

US Dominates Global RegTech Market in 2024 with 47% of All Investment Deals

In 2024, the global RegTech industry experienced a 43% decline in deal activity, with total funding dropping to $6.53 billion, a 36% decrease from 2023. The U.S. led the market, securing 303 deals but down from 572 the previous year. The UK and India also saw declines, while India emerged as a noteworthy player with 34 deals. Notably, Vanta secured the largest RegTech deal of the year, raising $150 million to enhance its AI-driven compliance platform, boosting its valuation to $2.45 billion. Despite the downturn, regulatory technology remains crucial for compliance solutions.