Similar Posts

Unlocking Banking Innovation: Temenos Unveils GenAI’s Revolutionary Impact on the Financial Sector

A survey by Hanover Research for Temenos reveals that 75% of banks are exploring Generative AI (GenAI) to enhance operational efficiency, with 36% already implementing it. Key motivations include improving customer experiences and driving growth. However, concerns persist regarding data protection (86%), compliance (60%), and the risk of inaccuracies (59%). Temenos CMO Isabelle Guis noted the dual nature of these findings, emphasizing the potential of GenAI alongside its challenges. Looking ahead, 73% of participants believe Agentic AI will transform banking. Temenos is supporting this shift with flexible deployment options and a partnership with NVIDIA to enhance GenAI solutions.

Docupace Acquires Hubly: Transforming Back-Office Operations for RIAs

Docupace, a leading provider of back-office software for WealthTech firms, has acquired Hubly, a workflow management platform, to enhance operational efficiency for registered investment advisors (RIAs) and wealth management firms. This strategic merger aims to streamline client service workflows and improve overall client experiences. The integration of Hubly into Docupace’s suite will facilitate a smooth transition for all stakeholders. Previous acquisitions have strengthened Docupace’s market position, aligning with trends in the financial services sector toward automation. Both CEOs expressed enthusiasm about the partnership, emphasizing their commitment to transforming wealth management into a more efficient and transparent experience.

Master Tax Reporting: Ensure Accuracy with Real-Time and Bulk TIN Validation Solutions

The IRS has expanded regulations to include digital assets, designating platforms, payment processors, and wallet providers as brokers, which imposes traditional reporting obligations. To aid compliance, companies are encouraged to utilize the IRS TIN matching program for verifying Taxpayer Identification Numbers (TINs), crucial for avoiding penalties under Sections 3406 and 6721. Best practices include collecting TINs at account opening, real-time matching, and bulk matching to ensure accuracy before reporting deadlines. Although Notice 2024-56 offers some relief, it doesn’t cover all obligations, highlighting the need for diligent TIN management. Businesses are urged to stay informed and proactive in compliance efforts.

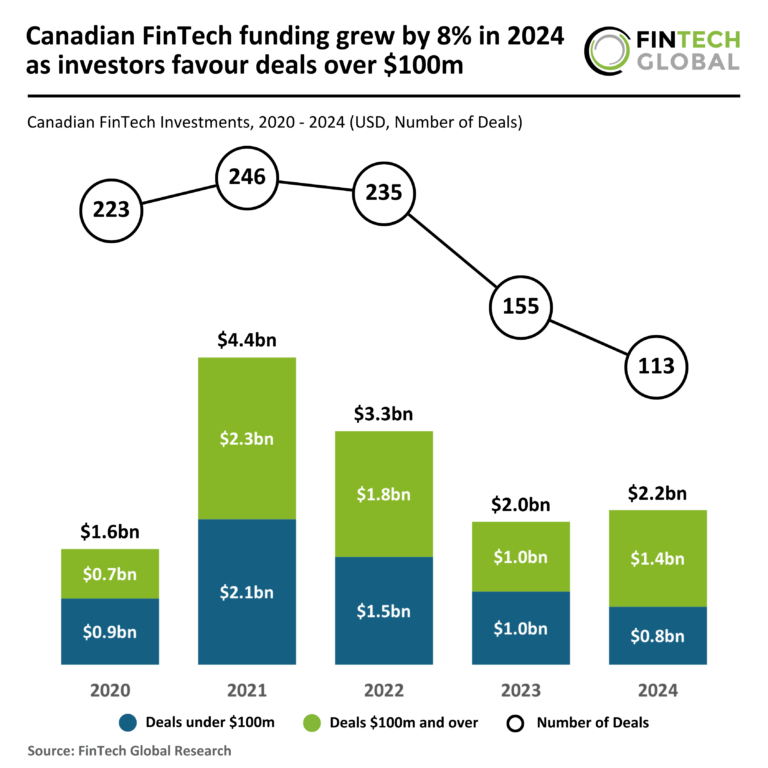

Canadian FinTech Funding Surges 8% in 2024: Investors Prefer $100M+ Deals!

In 2024, the Canadian FinTech sector experienced an 8% increase in funding, reaching $2.2 billion, up from $2 billion in 2023 and showing a 34% rise since 2020. However, the number of deals declined by 27% to 113, while the average deal size surged by 47% to $19.5 million. A notable trend is the shift towards larger deals, with investments over $100 million totaling $1.4 billion, a 38% increase from 2023. Cohere, a Toronto-based AI startup, secured the largest deal at $500 million, enhancing its total funding to $970 million and planning workforce expansion.

Brookfield Boosts Barclays with £400M Investment to Expand Merchant Payments Business

Barclays has partnered with Brookfield Asset Management to modernize its payment acceptance division, now rebranded as Barclaycard Payments. This collaboration aims to enhance services crucial for processing billions in transactions annually by investing approximately £400 million over three years. Brookfield will leverage its private equity expertise to support operational transformation. The agreement includes performance incentives and allows Brookfield to acquire up to a 70% stake within seven years, contingent on Barclays recovering its investment. The partnership marks Brookfield Financial Infrastructure Partners’ first deal, emphasizing a digital-first approach to improve client offerings and drive long-term growth in the FinTech sector.

New York’s Bold Action Against Illegal FinTech Payday Lending: A Game-Changer for Consumer Protection

New York Attorney General Letitia James is suing FinTech companies MoneyLion and DailyPay for allegedly exploiting hourly workers through illegal, high-interest payday loans. The lawsuits claim these companies misrepresent their services, promoting fee-based wage advances while imposing effective annual interest rates as high as 750%. Attorney James highlights the predatory nature of these practices, which mislead vulnerable New Yorkers and extract their hard-earned wages. DailyPay is accused of intercepting employee paychecks for repayments, while MoneyLion imposes mandatory fees on loans. The lawsuits aim to halt these operations, provide restitution, and enforce penalties for misleading lending practices.