Similar Posts

Transforming Wealth Management in 2025: The Impact of AI, Transparency, and Gen Z

In 2025, the wealth management sector is transforming due to global economic shifts, technological advancements, and changing investor expectations. Key trends include the impact of the evolving political landscape, demographic changes with younger populations in some regions, and the integration of AI for personalized client interactions and improved efficiency. Gen Z investors are influencing firms to prioritize sustainability and use digital platforms for engagement. Additionally, there is a growing demand for transparency in fund management and ESG disclosures. Firms that adapt to these trends will be better positioned to succeed in this complex environment.

Axyon AI and ALLINDEX Team Up to Transform Predictive Investment Research with Cutting-Edge AI Solutions

Axyon AI has partnered with ALLINDEX to enhance thematic investment strategies by combining Axyon AI’s predictive capabilities with ALLINDEX’s innovative research tools. This collaboration will empower investors to customize and optimize their portfolios with greater efficiency. Axyon AI offers advanced predictive analytics and recently expanded its products with AI-Powered Factors and AI-Compass for market insights. Meanwhile, ALLINDEX specializes in AI-driven thematic indices and research through its platform, Findall. Together, they aim to create tailored investment strategies, integrating advanced research and signal generation, redefining investment management in the AI era. Company leaders expressed enthusiasm about the partnership’s potential.

Boost ESG Investment Analysis: GIST Impact Leverages Global Canopy Datasets for Enhanced Insights

GIST Impact has partnered with Global Canopy to enhance how financial institutions assess deforestation risks in their decision-making processes. This collaboration merges Global Canopy’s datasets—Forest IQ and Forest 500—with GIST Impact’s analytics platform, allowing investors and banks to evaluate their exposure to deforestation and its financial implications. The integration aims to standardize deforestation risk analysis across the financial sector and promote better environmental, social, and governance (ESG) outcomes. GIST Impact plans to expand the Forest IQ dataset and support Global Canopy in broadening its reach, ultimately fostering greater accountability for environmental impacts in business operations.

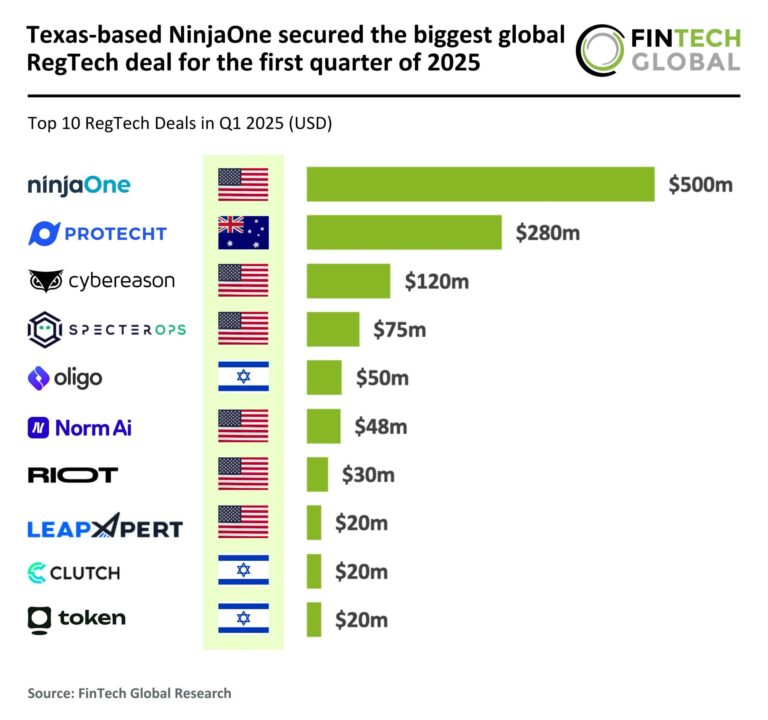

Texas-Based NinjaOne Clinches Record-Setting Global RegTech Deal in Q1 2025

In Q1 2025, global RegTech funding increased by 18% to $2.3 billion across 121 deals, signaling a recovery from the $6.5 billion raised in 2024. The U.S. dominated the market, securing 60% of top deals, while notable new players emerged, including Israel and Australia. The largest deal was NinjaOne’s $500 million Series C extension, aimed at enhancing its endpoint management capabilities for regulatory compliance. With over 24,000 customers globally, NinjaOne’s recent investment will also help acquire Dropsuite, bolstering its data protection services. As regulatory scrutiny and cyber threats grow, RegTech investments are poised for further growth.