Similar Posts

Ando Insurance Strengthens SSP Worldwide Partnership to Accelerate Digital Transformation

Ando Insurance, a leading New Zealand underwriting agency, has renewed and expanded its partnership with SSP Worldwide as part of its digital transformation strategy. This collaboration involves upgrading to SSP’s PURE Insurance System, a cloud-native platform designed to streamline operations, support growth, and enhance customer experience. The PURE Insurance System offers operational agility and scalability, focusing on innovation in areas like policy administration and broker platforms. Ando’s commitment to leveraging advanced technology aims to improve efficiency and strengthen relationships with policyholders. Chief Information Officer Mike Gardner emphasized the partnership’s role in delivering top-tier services and optimizing internal processes.

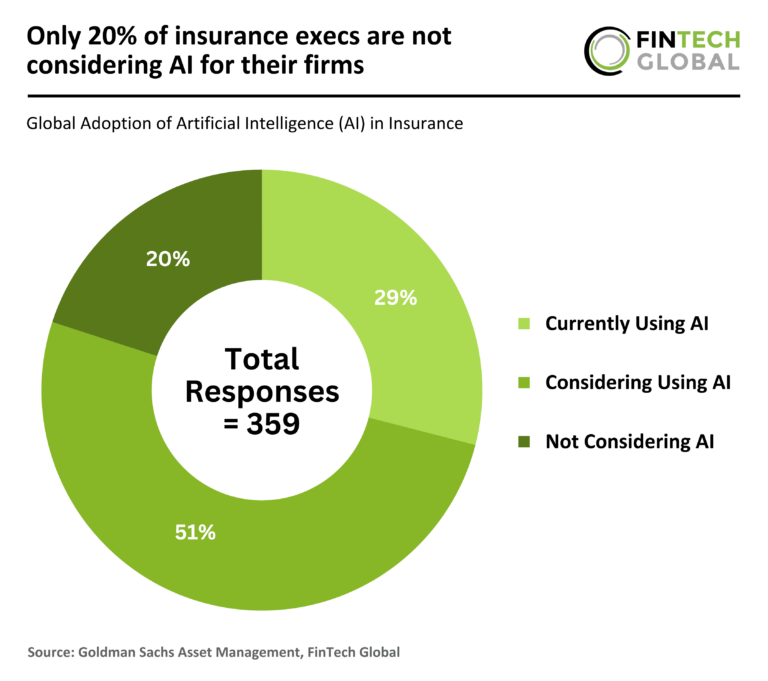

Revolutionizing Insurance: Why 80% of Executives Are Embracing AI for Business Growth

A Goldman Sachs Asset Management survey of 359 senior insurance professionals reveals increasing adoption of artificial intelligence (AI) in the industry. The survey shows that 29% of insurers have adopted AI, while 51% are exploring its implementation. Key applications include operational cost reduction, with 73% planning to use AI for this purpose, and 39% using it for improved risk assessment. As AI’s role expands, insurers are expected to refine strategies balancing innovation with regulatory compliance and ethical considerations. This trend is set to significantly enhance operational efficiency and decision-making processes in the insurance sector.

Unlocking the Future of Compliance: Why Voice Technology is the Next Governance Frontier

The field of Digital Communications Governance and Archiving (DCGA) is evolving rapidly due to regulatory pressures and the complexities of multi-channel communication. Voice data management poses unique challenges, including retention, accurate capture, and transcription, essential for compliance with regulations like MiFID II and SEC guidelines. Wordwatch offers a comprehensive compliance strategy integrating archiving, live capture, and advanced analytics, ensuring effective governance of both voice and digital communications. Projections indicate that by 2028, 80% of enterprises will unify governance across communication types. Wordwatch’s AI-driven solutions enhance compliance and cost-effectiveness by providing a single integrated platform, eliminating hidden costs.

INVESTBANK and Fintech Galaxy Pioneering Open Banking Compliance: A New Era of Financial Innovation

INVESTBANK in Jordan has partnered with Fintech Galaxy to modernize financial services and enhance customer experiences through Open Banking and Open Finance. This collaboration aims to ensure compliance with new regulations, integrate into the local Open Finance ecosystem, and improve digital offerings. Fintech Galaxy, recently approved by the Central Bank of Jordan to test Open Banking APIs, will support INVESTBANK with its FINX Comply suite, which includes tools for Third Party Providers (TPPs) and consent management. The partnership is expected to reduce compliance costs, improve operational efficiency, and create new revenue opportunities, transforming the financial landscape in Jordan.

Jump Secures $20M to Boost AI-Driven Efficiency for Financial Advisors

Jump, an AI solutions provider for financial advisors, has raised $20 million in a Series A funding round led by Battery Ventures, with contributions from Citi Ventures and others, bringing its total funding to $24.6 million. The investment aims to enhance advisor productivity through AI tools for automation, compliance, and data management. Since exiting beta in January 2024, Jump has experienced over 35% monthly growth and partnered with firms like LPL Financial. CEO Parker Ence emphasized the platform’s efficiency, saving advisors an average of one hour per workday, while enhancing client engagement and compliance.

British Business Bank Invests £50M in Elbow Beach to Propel UK Climate Tech Innovation

Elbow Beach, a seed investor in climate technology, has announced a significant boost to its Climate Impact Fund 2, receiving up to £50 million from the British Business Bank. The fund has secured £63 million in total commitments, with £40 million available for immediate deployment. This funding will support up to 36 innovative British startups over the next four years, focusing on areas such as automation, AI, carbon capture, electrification, and low-carbon materials. Both Elbow Beach and the British Business Bank emphasize the importance of fostering startups that address crucial climate challenges and contribute to the UK’s leadership in climate tech innovation.