Similar Posts

Whalebone Secures €13.35M in Funding to Accelerate Global Expansion in Cybersecurity Solutions

Whalebone, a cybersecurity firm specializing in telecommunications, has raised €13.35 million (around $14 million) in Series B funding, led by London-based Unbound, with support from existing investors. This investment will enhance Whalebone’s global expansion, customer success initiatives, and product development. The company aims to strengthen its presence in both the enterprise and public sectors while improving threat intelligence capabilities. Recently, Whalebone expanded into the APAC region, partnering with major telecom providers. Leaders from Unbound expressed confidence in Whalebone’s innovative cybersecurity solutions, highlighting the urgent need for enhanced protection against rising cyber threats.

Hitachi ZeroCarbon and MUFG Join Forces to Eliminate Cost Barriers for Fleet Electrification

Hitachi ZeroCarbon has partnered with MUFG to accelerate the electrification of commercial vehicle fleets, addressing key barriers to electric vehicle (EV) adoption: high upfront costs and operational complexities. This collaboration supports fleet operators facing pressure to decarbonize, offering integrated solutions that combine financial resources with technological innovation. The partnership enables fleets to efficiently scale electrification while managing assets through Hitachi’s platform. Already in action with First Bus, which aims to transition 4,500 vehicles to electric by 2035, this initiative emphasizes financial viability for fleet managers, facilitating a quicker move toward net-zero targets and enhancing sustainability and profitability.

Singapore Unveils Essential Guidebook for Climate Disclosure Professionals to Enhance Skills

Singapore has launched the Sustainability Reporting Body of Knowledge (SR BOK) to enhance sustainability reporting education and align local training with international standards set by the ISSB. Unveiled on May 19, 2023, by the Accounting and Corporate Regulatory Authority (Acra), the SR BOK provides a comprehensive guide for course developers, covering essential topics like greenhouse gas accounting and climate transition planning. As Singapore prepares for mandatory climate disclosures for listed companies, this initiative aims to build a skilled workforce. Acra, in collaboration with over 50 stakeholders and SkillsFuture Singapore, emphasizes the importance of developing consistent and practical training programs.

FDATA Champions Rapid Open Finance Adoption in Canada’s Budget Strategy

The Financial Data and Technology Association of North America (FDATA) has called on Canada’s Department of Finance to expedite Open Finance implementation in Budget 2025, aiming to enhance financial transparency and accessibility for consumers and SMEs. In its pre-budget submission, FDATA recommended a swift, regulated rollout of Open Banking, including small business accounts, adequate funding for the Financial Consumer Agency of Canada (FCAC), and consumer education. It also proposed a tiered compliance enforcement by the FCAC to foster innovation while maintaining system integrity. FDATA advocates for an immediate initiation of the Open Finance framework to boost market competition.

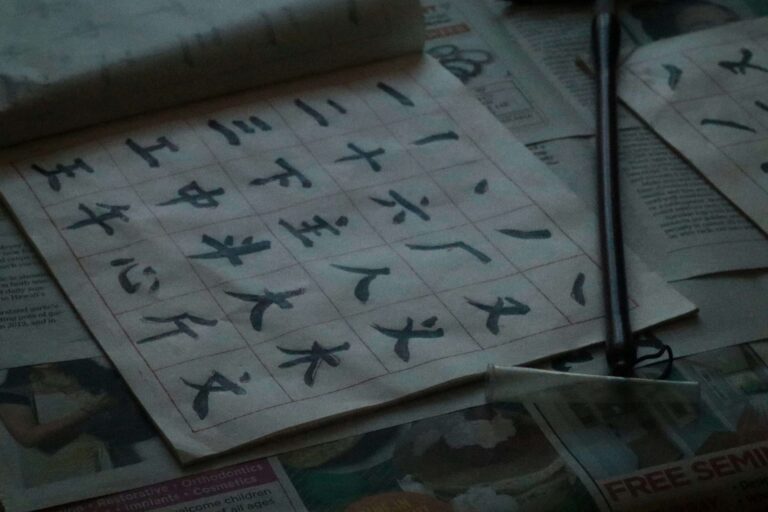

Mastering Name Screening: Tackling Challenges in Chinese and Non-Latin Scripts

Accurate name matching is vital for regulatory compliance in KYC and AML processes, yet it faces challenges due to language and script variations. IMTF has partnered with Babel Street to improve name matching precision and reduce compliance risks. Their guide highlights the complexities of screening names, especially in non-Latin scripts like Chinese, where transliteration can lead to ambiguity. Traditional methods often produce false positives and negatives, increasing operational costs and regulatory exposure. Babel Street’s innovative two-pass hybrid approach, integrated into IMTF’s Siron One, utilizes AI-driven techniques to enhance accuracy, supporting 24 scripts and streamlining compliance efforts.

Red Flag Alert Secures £4M Series A+ Funding to Strengthen Market Position and Drive Growth

Red Flag Alert, a Manchester-based business intelligence platform, has secured a £4 million Series A+ investment from Foresight Group and Ric Traynor, following a previous £3.5 million investment. The funding will support strategic expansion across five industries: Financial Services, Accounting, Legal, Construction/Manufacturing, and Business Utilities. The company has experienced significant growth, with its Annual Recurring Revenue (ARR) rising from £1.8 million to £5.2 million, aiming for £10 million within two years. CEO Richard West highlighted increased inquiries from enterprise clients, while Vincent Kilcoyne has been appointed Chief Product Officer to drive product development.