Similar Posts

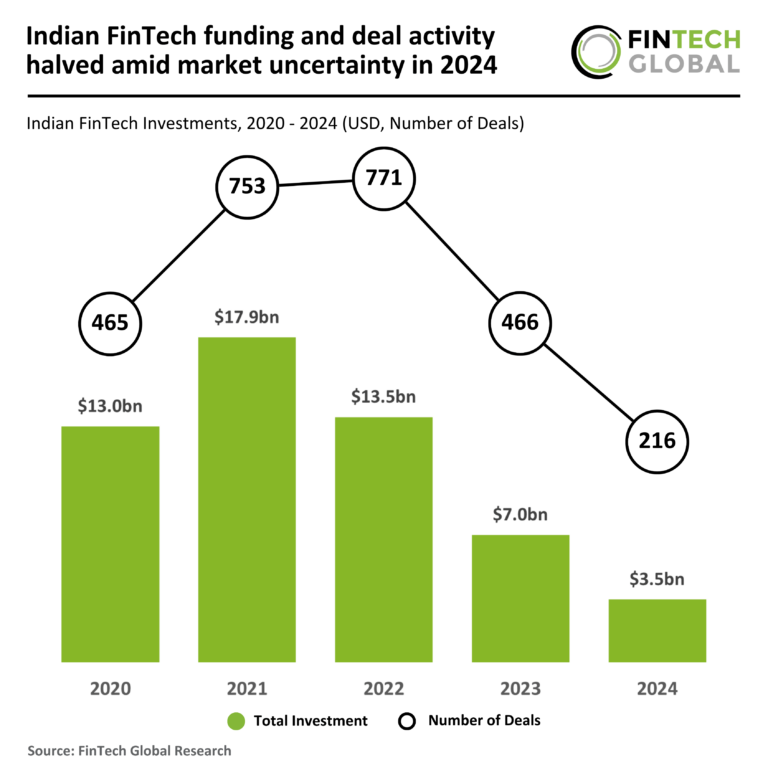

2024 Indian FinTech Landscape: Funding and Deal Activity Plummets Amid Market Uncertainty

In 2024, the Indian FinTech sector faced a significant downturn, with funding and deal activity plummeting. Total deals fell by 54% to 216, while funding dropped 51% to approximately $3.5 billion, marking the lowest deal count in five years. Despite this decline, the average deal size increased slightly to $16.1 million. A notable highlight was Svatantra, a microfinance company, raising $230 million, focusing on empowering women entrepreneurs. Svatantra leads in cashless disbursements and has developed a customer app to enhance engagement. As the industry evolves, stakeholders must adapt to navigate the changing landscape effectively.

Revolutionizing Transaction Monitoring: The Impact of False Positive Reduction

Transaction monitoring is crucial for preventing fraud, but institutions face challenges with false positives—legitimate transactions flagged as suspicious. Laurence Hamilton of Consilient notes that while large organizations are improving, smaller firms still struggle due to limited technical expertise, regulatory scrutiny, and outdated systems. AI and machine learning offer potential solutions by enhancing detection capabilities and allowing for dynamic learning. However, balancing false positives and compliance risks is essential to maintain operational efficiency and customer experience. As transaction volumes grow, adopting AI technologies is vital for transforming compliance practices and effectively managing financial crime risks.

Allianz Partners UK Expands Roadside Assistance Collaboration with Volvo Car UK for Enhanced Driver Support

Allianz Partners UK has been reaffirmed as the exclusive roadside assistance provider for Volvo Car UK for the next three years, enhancing customer support for both new and used vehicles. This partnership, ongoing since 2010, adapts to market changes, including the rise of electric vehicles (EVs), and integrates Volvo’s diagnostic tools. Key features include the Service Activated Roadside Assistance program, which offers an extra year of support when servicing at authorized retailers, and flexible mobility options. Allianz aims to innovate and improve customer service, reflecting a commitment to sustainability and advanced assistance solutions in collaboration with Volvo.

FinTech Funding Surge: Over $1 Billion Raised This Week – Discover the Latest Deals!

In 2025, the FinTech sector began strongly, raising $1.2 billion across 30 deals within three weeks, with weekly totals exceeding $1 billion. Notable funding included Deel’s $300 million for its payroll platform and Openly’s $193 million for home insurance. The majority of investments targeted US-based firms, with Germany and the UK also participating. India emerged as Asia’s leading FinTech hub, despite a decline in deals. Key trends included a focus on infrastructure and enterprise software, while AI and generative AI were highlighted as disruptive technologies in asset management. The sector’s growth continues to attract significant investor interest.

authID Partners with TechDemocracy for Seamless and Secure Access Solutions

authID has partnered with TechDemocracy to enhance passwordless authentication in enterprises through advanced biometric solutions. This collaboration will certify 25 professionals to implement authID’s tools, including Proof and PrivacyKey™, which feature one-in-a-billion false match rates and ensure data privacy by not storing biometric data. The partnership aims to provide secure, frictionless access for enterprises and includes the development of QuickStart accelerators for smoother integration. Both companies will promote knowledge on biometric authentication through white papers, webinars, and workshops, with TechDemocracy’s leadership expressing excitement about expanding their security offerings.

Snugg Unveils Game-Changing Carbon Cashback Platform in the UK: A New Era for Sustainable Living

Snugg, an Edinburgh-based home energy efficiency platform, has launched a beta version of its innovative program, Carbon Cashback, aimed at encouraging homeowners to enhance their energy efficiency. The initiative rewards homeowners financially for reducing carbon emissions, offering potential earnings of up to £2,000 over a decade through investments in energy-efficient technologies like heat pumps and solar panels. Carbon Cashback tracks carbon savings via smart meters, converting them into tradable carbon credits. It also presents collaboration opportunities for businesses to bolster their sustainability initiatives. Snugg’s leadership emphasizes the program’s potential to make sustainable living financially rewarding and accessible.