Similar Posts

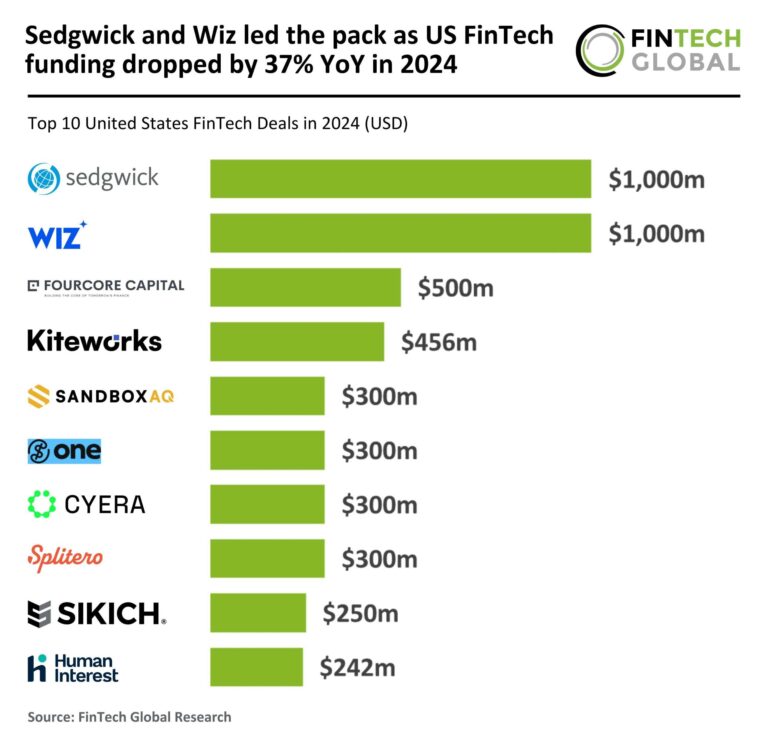

Sedgwick and Wiz Dominate Amidst 37% YoY Decline in US FinTech Funding for 2024

In 2024, the US FinTech industry faced a 37% drop in funding, with total investments plummeting to $51 billion from $80.4 billion in 2023. The number of deals also declined by 56%, with only 1,868 transactions recorded. Despite this downturn, the average deal value increased to $27.3 million, an 18% rise from the previous year, indicating a trend towards larger investments in established firms. A notable success was Kiteworks, which raised $456 million, highlighting the concentration of funding in fewer, high-potential companies amid a cautious investment climate.

Boost Compliance and Risk Management with Real-Time Data Solutions

Regulatory technology (RegTech) has become crucial for financial institutions navigating the evolving compliance landscape. Real-time data plays a vital role in streamlining compliance processes and managing risks related to regulations like AML, KYC, MiFID II, and GDPR. Platforms such as Opoint integrate updates from over 235,000 sources, automating alerts for regulatory changes and enabling institutions to focus on priority areas. Despite challenges in integrating new solutions with legacy systems, Opoint’s technology facilitates seamless adoption of advanced compliance tools. As regulatory scrutiny increases, real-time data has shifted from optional to essential for effective risk management and compliance.

KCB Bank Kenya and Mastercard Launch Groundbreaking Multi-Currency Prepaid Card: A First for the Nation!

KCB Bank Kenya has partnered with Mastercard to launch Kenya’s first multi-currency prepaid card, facilitating international transactions in 11 currencies, including the Kenyan Shilling, US Dollar, and Euro. The card offers advantages such as reduced transaction fees, enhanced spending control, and a self-service portal for tracking expenses. It benefits various users, including students, business professionals, and athletes traveling abroad. KCB’s Director of Digital Financial Services, Angela Mwirigi, emphasized the importance of this collaboration, while Mastercard’s Shehryar Ali highlighted its role in simplifying cross-border transactions. This initiative aims to improve Kenya’s financial landscape and ease currency management.

Weavr Launches Innovative Embedded Payment Solution in Partnership with Paperchase

Weavr, a UK provider of embedded finance solutions, has partnered with Paperchase, a leader in financial management for hospitality, to launch the Embedded Payment Run (EPR) solution. This innovation aims to streamline Accounts Payable (AP) processes, particularly in fast-paced sectors, by facilitating near-instant transactions and minimizing errors through an integrated system. Research shows strong demand for integrated workflows, with 94% of AP professionals wanting payment processing within existing platforms. Leaders from both companies highlight the partnership’s potential to cut costs and improve efficiency while opening new revenue streams. The EPR solution is poised to revolutionize financial operations across industries.

SCOR Appoints Philipp Rüede as New CEO of Life & Health Division: A Strategic Leadership Move

SCOR has appointed Philipp Rüede as the new CEO of its Life & Health (L&H) division, effective June 1, 2025. He succeeds Frieder Knüpling and will focus on implementing SCOR’s updated strategy, targeting business growth, preserving in-force value, and enhancing cash flow. Rüede, a dual Swiss and German national with over 20 years of experience in banking and reinsurance, previously worked at Swiss Re and other financial institutions. SCOR aims to transform its L&H division under his leadership, with CEO Thierry Léger expressing confidence in Rüede’s skills and experience to drive this transformation.

Unlocking the Future: Harnessing AI and Real-Time Solutions for AML Compliance by 2025

In 2025, the Anti-Money Laundering (AML) landscape is transforming due to stricter regulations and the need for efficient risk management. A recent webinar highlighted key compliance challenges faced by financial institutions, emphasizing the need for advanced fraud management tools and enhanced collaboration. The shift towards Enhanced Due Diligence (EDD) aims to streamline processes and reduce costs while aligning with business growth. Technological advancements, especially in AI, are crucial for improving compliance accuracy, though only 28% of institutions currently use AI. Future investments will focus on transaction monitoring, KYC processes, and continuous education to navigate the evolving regulatory environment successfully.