Similar Posts

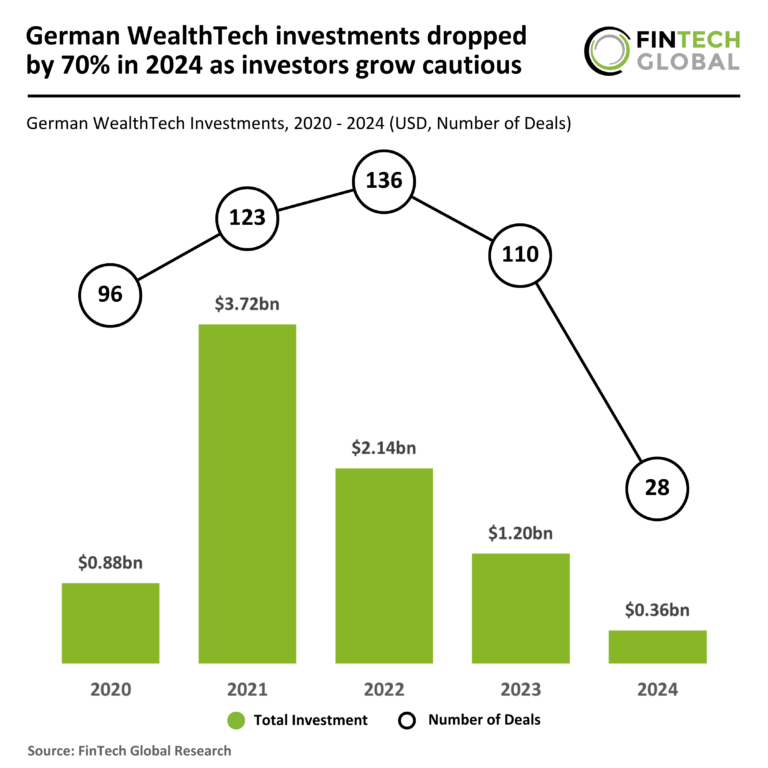

German WealthTech Investments Plummet 70% in 2024 as Investor Caution Surges

In 2024, Germany’s WealthTech sector experienced a significant downturn, with investment activity falling 70% year-on-year. Funding dropped from $1.204 billion in 2023 to $362 million, with only 28 deals recorded, an 82% decrease. The average deal value also declined to $12.9 million. Investors are now more cautious, focusing on established companies with proven business models. Amidst this backdrop, QPLIX secured a notable $26.5 million funding round from Partech to enhance its wealth management software, supporting its expansion into international markets such as France and the UK. The sector must adapt to attract future investments.

FinTech Funding Soars: $477.6 Million Raised in a Remarkable Week!

Last week, the FinTech sector experienced a significant investment surge, totaling $477.6 million across 16 deals, particularly in enterprise and investment software. Highlights include Amsterdam-based Finom raising $105 million for SME banking and HubSync securing over $100 million for tax automation. The PayTech sector saw Glide raise $15 million, while WealthTech’s Wagestream garnered $39.9 million for financial wellbeing. The U.S. led with five funding rounds, while Europe accounted for eight, totaling around $231.2 million. Notable funding rounds also included Ox Security ($60 million) and Doppel ($35 million) to enhance their respective services.

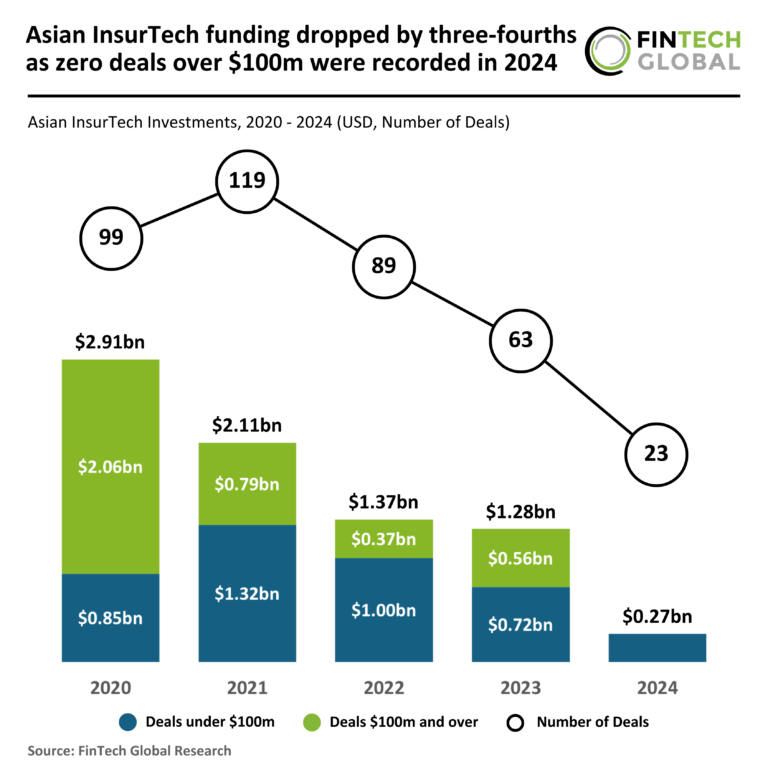

2024 Sees Dramatic 75% Decline in Asian InsurTech Funding with No Deals Exceeding $100M

In 2024, the Asian InsurTech industry experienced a dramatic funding decline, with investments falling 79% to just $269 million, down from $1.3 billion in 2023. The number of deals plummeted to 23, a 63% decrease from the previous year. Notably, no deals exceeding $100 million were recorded. Despite this downturn, Peak3 emerged as a success story, securing a $35 million Series A funding round, the largest InsurTech deal in Asia this year. This funding will support Peak3’s expansion into the EMEA region and enhance its AI-driven insurance solutions, amidst a cautious investment environment.

Klarna and BHN Launch Gift Card Store Expansion in Germany, Italy, and The Netherlands

Klarna is expanding its Gift Card Store in partnership with Blackhawk Network, introducing services to Germany, Italy, and the Netherlands after successful launches in the U.S. and U.K. Customers will soon access a wide range of gift cards from popular brands like H&M, LEGO, and NIKE, with payment options including Klarna’s Buy Now, Pay Later and Pay in Full. This initiative aims to enhance consumer shopping experiences and tap into the growing gift card trend in Europe. Klarna’s head of Northern and Central Europe emphasizes the partnership’s potential to redefine gift-giving and boost retailer engagement.

MirrorTab Secures $8.5 Million to Tackle Advanced Browser-Based Cyber Threats

MirrorTab, a cybersecurity firm, has raised $8.5 million in seed funding led by Valley Capital Partners, with significant contributions from other investors. The funding aims to enhance web application protection through advanced isolation technology that secures data and APIs, effectively eliminating the browser as an attack surface. This investment will support innovations, integrations, and commercial expansion to combat increasingly sophisticated cyber threats. CEO Brian Silverstein emphasized the evolving nature of attacks exploiting browsers, while advisor Allison Miller noted that MirrorTab’s solution provides unique session security that traditional tools lack. Investors recognize the critical need for such innovative defenses against cyberattacks.