Similar Posts

Transforming European Banking Digitalisation: Tietoevry and Version 1 Unite for a New Era

Tietoevry Banking has partnered with Version 1 to enhance the digitalisation of the banking sector in Europe. This strategic alliance combines Tietoevry’s Software as a Service (SaaS) solutions with Version 1’s expertise in banking system modernisation. The partnership aims to equip financial institutions with essential tools to adapt to changing market demands and customer expectations. Key benefits include enhanced digital services, modular SaaS solutions for improved customer personalisation, and advanced AI compliance and risk management capabilities. Targeting growth in the UK, Ireland, and Spain, the collaboration emphasizes innovation and aims to create modern, customer-centric banking experiences.

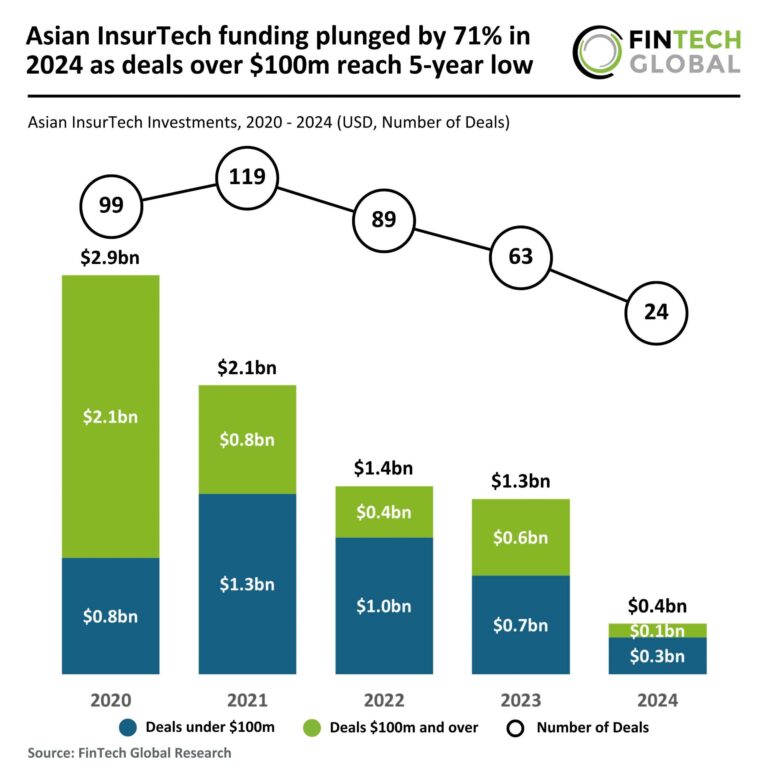

2024 Sees 71% Drop in Asian InsurTech Funding: Deals Over $100M Hit 5-Year Low

In 2024, the Asian InsurTech sector faced a drastic downturn, with funding plummeting by 71% to $369 million, down from $1.3 billion in 2023. The number of deals also dropped by 63%, totaling just 23, while the average deal size declined by 21% to $16 million. High-value deals fell to a five-year low, with only $100 million raised, reflecting increased investor caution. Despite this, bolttech secured the largest funding round of the year, raising over $100 million in its Series C, aiming to enhance its platform and expand globally. The landscape remains challenging for stakeholders navigating these trends.

FinTech Funding Soars Beyond $1.1 Billion with 18 Exciting Deals!

This week saw over $1 billion invested in the global FinTech ecosystem, with 18 transactions totaling $1.13 billion. Notable deals included Rippling’s $450 million raise, Addepar’s $230 million, and Bestow’s $120 million. The U.S. led with nine deals, followed by the U.K. with five. RegTech, FinTech, WealthTech, and PayTech sectors showed strong activity. Rippling’s funding raised its valuation to $16.8 billion, while Addepar reached $3.25 billion. Stash secured $146 million to enhance its AI-driven financial advice platform. These investments reflect a trend towards technology-driven solutions that improve operational efficiency and customer service in the FinTech sector.

Boost Your Checkout Experience: Skipify and Retail Realm Join Forces for Identity-Powered Payment Solutions

Skipify, a FinTech leader in checkout enhancement, has partnered with Retail Realm, a global retail solutions provider and Microsoft ISV. This collaboration allows Retail Realm’s 50,000 merchants to integrate Skipify’s Commerce Identity Cloud, introducing a pay-by-link feature that enables customers to complete transactions via SMS or email, improving satisfaction. The integration automates shopper identification, removes manual card entry, and connects with major card networks, leading to a 6% increase in approval rates, 9% boost in conversion rates, and 12% rise in repurchase rates. Both companies aim to simplify payments and enhance customer experience in retail.

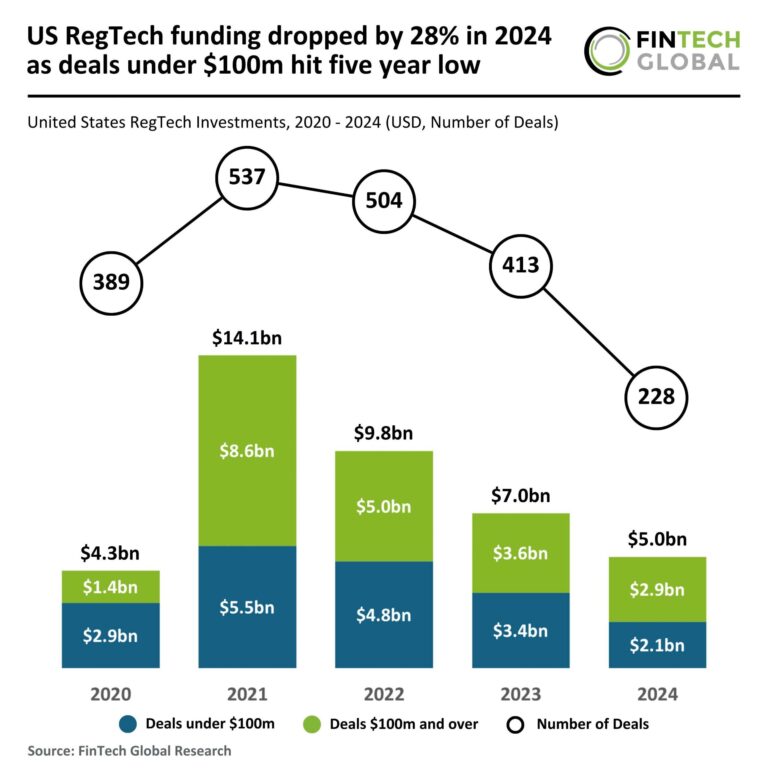

US RegTech Funding Plummets 28% in 2024: Deals Under $100M Reach Five-Year Low

In 2024, the US RegTech investment landscape saw a significant decline, with total funding dropping 28% to $5 billion and deal volume decreasing 45% to 228. Smaller deals under $100 million fell to $2.1 billion, the lowest in five years, while larger deals remained more stable, totaling $2.9 billion. Amid this downturn, Norm AI stood out, securing a $27 million Series A funding round led by Coatue, with additional investments from firms like Bain Capital Ventures. Norm AI specializes in AI-driven regulatory compliance, dramatically improving efficiency for major corporations.

FinTech Funding Surges Past $1 Billion: A Look at the Limited Deals Driving Growth

In a significant week for the FinTech sector, funding reached $1.23 billion, bolstered by investments in open banking and cybersecurity. Open banking leader Plaid led with a $575 million secondary share sale, reflecting strong interest in the financial technology space, despite a valuation drop to $6.1 billion. Other notable developments included substantial deals in WealthTech and InsurTech, highlighting the diverse opportunities within the industry. Overall, the week underscored the resilience and potential of FinTech amidst evolving market dynamics.