Similar Posts

Flagright Raises $4.3M to Revolutionize AI-Driven AML Solutions in FinTech

Flagright, an AI-driven AML compliance platform, has raised $4.3 million in seed funding, led by Frontline Ventures. The funds will enhance Flagright’s innovative solutions and support global growth, particularly crucial as financial institutions face rising fraud threats, including a notable $25 million incident in Hong Kong linked to deepfake technology. Founded in 2022, Flagright offers tools like dynamic risk scoring and real-time monitoring, achieving significant reductions in false positives and manual efforts. The funding will accelerate product innovation, including a new AI Forensics line aimed at transforming compliance workflows. CEO Baran Ozkan expressed optimism about scaling the company’s solutions.

AI Cybersecurity Startup Augur Secures $7M Funding to Enhance Threat Prevention Platform

Augur, an AI-powered threat prevention company, has raised $7 million in seed funding to enhance its predictive cybersecurity platform and expand its market presence. The funding round, led by General Advance, featured contributions from industry leaders such as Ely Kahn from SentinelOne and executives from Amazon, Cloudflare, and Google. Augur’s platform uses AI to monitor internet activity and detect potential cyber threats early, allowing organizations in sectors like finance, healthcare, and energy to proactively address risks. CEO Joe Lea highlighted the need for AI-driven solutions to combat increasingly sophisticated cyber threats.

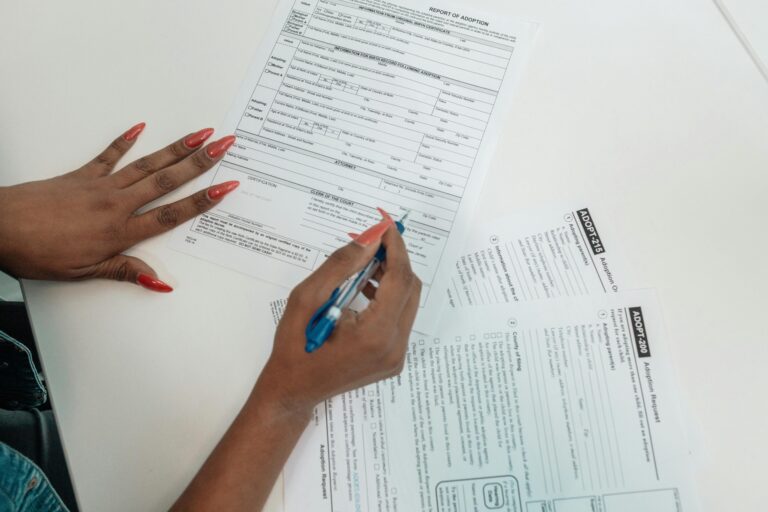

Unlocking Compliance: The Power of Traceability from Audit Trails to Accountability

Organizations are now pressured to adopt proactive regulatory compliance, moving beyond mere checklist approaches. Traceability is essential for understanding compliance actions and their contexts, fostering trust in internal controls. Integrated compliance frameworks enable dynamic strategies and enhance audit clarity, but challenges like manual processes and undocumented knowledge persist. Robust compliance programs must align with regulations and be supported by real-time monitoring. Firms should build a culture of accountability and maintain agility in their compliance frameworks to avoid penalties. Ultimately, successful compliance requires a blend of technology, processes, and people, ensuring transparency and trust in regulatory relationships.

EcoVadis Launches Innovative Carbon Data Network for Enhanced Scope 3 Emission Tracking

EcoVadis has launched its Carbon Data Network, a groundbreaking platform aimed at improving how businesses collect and share carbon data from suppliers, crucial for meeting net-zero goals. This network streamlines the collection of greenhouse gas emissions data, particularly for challenging Scope 3 indirect emissions. Supported by the Carbon Action Manager, it includes a database from over 150,000 organizations and tools for enhanced carbon management. Collaborating with partners like Sweep and Normative, EcoVadis emphasizes the importance of reliable data in achieving sustainability targets. This initiative empowers businesses to make informed decisions and accelerates their decarbonization efforts.

Ecommpay Unveils Innovative Italian Payments Suite to Fuel E-Commerce Growth

Ecommpay, a global payments platform, is enhancing support for international e-commerce merchants entering the Italian market by offering localized payment options. This initiative addresses the issue of basket abandonment due to unfamiliar payment methods, crucial for thriving in Italy’s $51 billion e-commerce sector. Ecommpay’s solutions include acquiring, card processing, and alternative payment methods like Satispay and MyBank, improving acceptance rates by 2-3%. With 69% of online transactions using digital payments, Ecommpay aims to optimize user experience through multilingual support, helping merchants create a seamless checkout process and boost customer loyalty in Italy’s dynamic market.

Unlocking Compliance: The Essential Shift from Outdated Call Systems

Industries like finance, insurance, healthcare, and legal are increasingly pressured to upgrade outdated call recording systems to avoid compliance breaches. Legacy technologies pose risks, including financial penalties, reputation damage, and heightened regulatory scrutiny. Regulations such as MiFID II and GDPR mandate strict data retention for voice recordings, with recent penalties highlighting the consequences of non-compliance. Outdated systems lack essential features like security patches and efficient data retrieval. Modern call recording solutions can automate compliance and ensure data integrity. Wordwatch offers a platform for seamless migration and compliance. A webinar in May will provide strategies for transitioning to modern systems.