Similar Posts

Understanding Cultural Influences: Key to Effective Financial Crime Compliance

Understanding cultural differences is crucial for effective financial crime risk assessments, as they significantly impact compliance and risk management strategies, according to Arctic Intelligence. Varied attitudes towards corruption influence local business practices and regulatory enforcement, with some regions tolerating bribery while others impose strict anti-bribery laws. Challenges include navigating diverse regulations, overcoming resistance to compliance, and addressing awareness gaps. Best practices involve localized assessments, culturally aware compliance programs, enhanced training, and aligning local metrics with global standards. Future trends suggest a move towards global standardization, technological advancements, and increased focus on high-risk regions, making cultural insights essential for effective risk management.

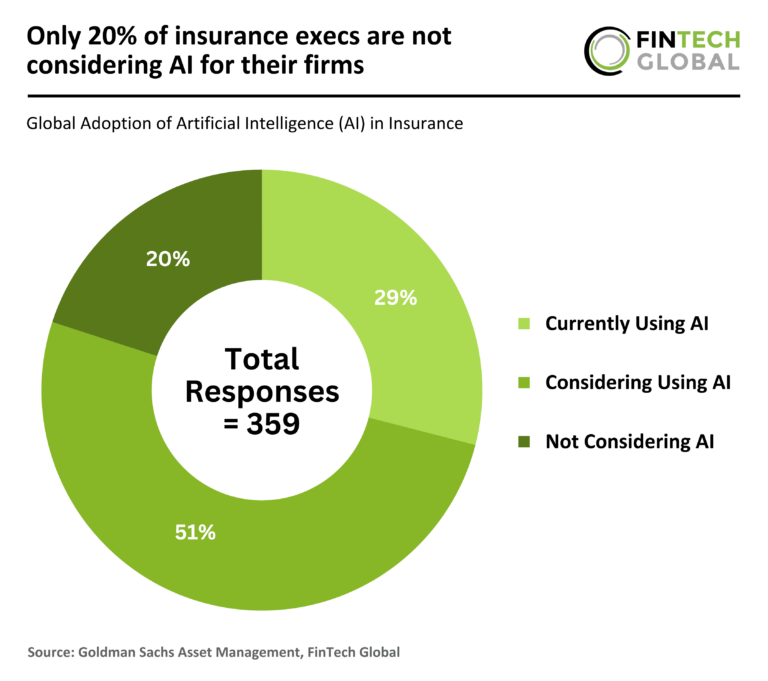

Revolutionizing Insurance: Why 80% of Executives Are Embracing AI for Business Growth

A Goldman Sachs Asset Management survey of 359 senior insurance professionals reveals increasing adoption of artificial intelligence (AI) in the industry. The survey shows that 29% of insurers have adopted AI, while 51% are exploring its implementation. Key applications include operational cost reduction, with 73% planning to use AI for this purpose, and 39% using it for improved risk assessment. As AI’s role expands, insurers are expected to refine strategies balancing innovation with regulatory compliance and ethical considerations. This trend is set to significantly enhance operational efficiency and decision-making processes in the insurance sector.

Mastering Financial Crime and Compliance Challenges: A 2025 Guide to Navigating Risks and Regulations

As 2025 approaches, businesses face increasing challenges in regulatory compliance, especially those in sectors prone to financial crime. A report by SmartSearch highlights the urgent need for improved compliance measures among 600 surveyed decision-makers, who view regulatory pressures as barriers to growth. Companies must adopt integrated strategies, utilize technology, and continuously evaluate compliance frameworks. The rising complexity and costs of compliance necessitate agile and cost-effective solutions. However, advancements in AI and machine learning offer opportunities to streamline processes, reduce costs, and mitigate risks. Embracing innovation is essential for businesses to thrive amid evolving compliance demands.