Similar Posts

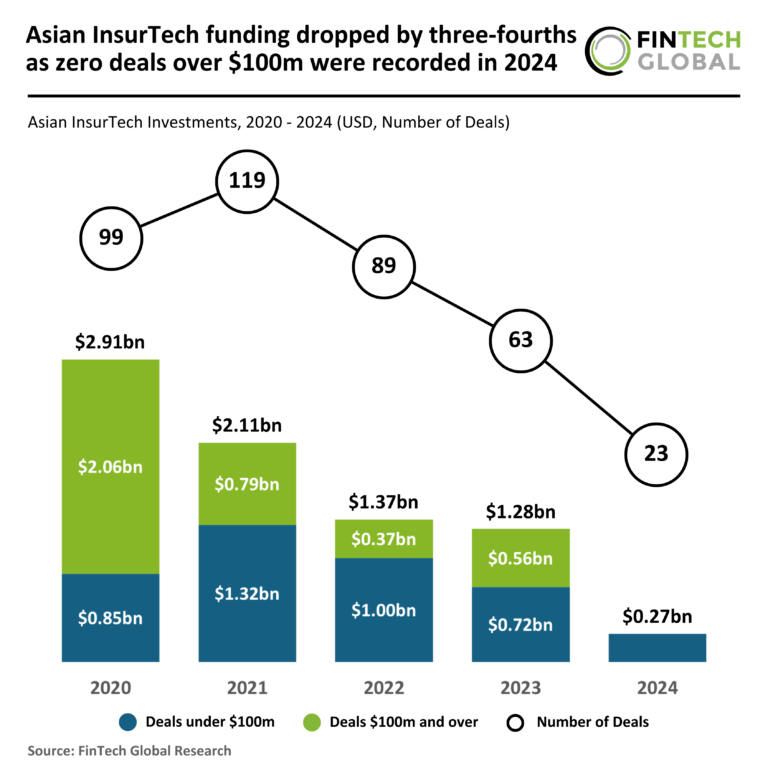

2024 Sees Dramatic 75% Decline in Asian InsurTech Funding with No Deals Exceeding $100M

In 2024, the Asian InsurTech industry experienced a dramatic funding decline, with investments falling 79% to just $269 million, down from $1.3 billion in 2023. The number of deals plummeted to 23, a 63% decrease from the previous year. Notably, no deals exceeding $100 million were recorded. Despite this downturn, Peak3 emerged as a success story, securing a $35 million Series A funding round, the largest InsurTech deal in Asia this year. This funding will support Peak3’s expansion into the EMEA region and enhance its AI-driven insurance solutions, amidst a cautious investment environment.

FinScan Boosts Payment Screening for Speedy and Secure Transactions

FinScan, a leading anti-money laundering (AML) compliance solution from Innovative Systems, has recently enhanced its payment screening capabilities through FinScan Payments. This update aims to streamline transaction workflows while reinforcing measures against financial crime. Investment in Payment Modernization by Financial Institutions Recent research conducted by Datos Insights indicates that a substantial 91% of surveyed financial…

CFA Institute Unveils Comprehensive Guide to Net-Zero Investment Strategies for Sustainable Finance

The CFA Institute Research and Policy Center has released “Investment Innovations Toward Achieving Net Zero: Voices of Influence,” a guide aimed at promoting net-zero investing strategies. Featuring insights from over 50 experts, it outlines 16 research papers with actionable strategies, emphasizing international cooperation, fiduciary duties, and carbon pricing trends. The guide offers practical tools for investors, including case studies on Danish pension fund methodologies and municipal green finance initiatives in China. Chris Fidler highlights the necessity of standardized climate disclosures for informed decision-making. This resource serves to help investors align financial goals with sustainability efforts in an evolving market.

Jericho Security Secures $15M Funding to Revolutionize AI-Driven Cybersecurity Solutions

Jericho Security, a New York-based cybersecurity firm, has raised $15 million in a Series A funding round, bringing its total capital to $20 million since its 2023 inception. Led by Era Fund and supported by investors like Dash and Lux Capital, the funding will enhance its AI-powered employee training solutions against cyber threats, particularly phishing and deepfakes. The platform features dark web intelligence to create realistic training simulations. CEO Sage Wohns highlighted the dynamic nature of modern phishing attacks, emphasizing the need for innovative defenses powered by AI. Jericho also offers a self-service portal with a seven-day free trial for users.

Unlocking Opportunities: How Regulatory Changes Are Revolutionizing Scalable Digital Investment Services

The investment services industry is shifting its perspective on compliance, viewing it as a growth catalyst amidst significant regulatory changes. everyoneINVESTED highlights opportunities from new regulations in Europe and the UK, such as the Retail Investment Strategy. These reforms can lead to increased IT investment, business expansion, enhanced retail investor participation, and greater digitization. As modern portfolio theory loses relevance in today’s digital landscape, behavioral economics is emerging to better understand investor decision-making. By embracing these insights, firms can transform compliance into a driver of growth, fostering a more inclusive investment environment.

Transforming InsurTech: How Evolving Customer Needs Will Shape the Industry in 2025

In 2025, the InsurTech landscape will undergo a major transformation driven by changing consumer expectations for instant services, personalized insurance, and seamless online experiences. Insurers are adopting advanced technologies, including AI and automation, to enhance customer interactions and streamline processes. Key trends include the rise of instant services, hyper-personalized policies, and the integration of AI-driven assistants. Insurers must also navigate regulatory pressures and a growing focus on sustainability. Industry experts, including leaders from Simplifai and Ushur, emphasize the importance of innovative customer engagement strategies that balance efficiency and personal connection in this evolving market.