Similar Posts

Enhancing Employee Engagement and Compliance: How Theta Lake Integrates Seamlessly with Workvivo

In the evolving work landscape, hybrid and remote setups necessitate tools like Zoom’s Workvivo to enhance workplace culture. However, increased usage raises compliance risks for regulated sectors like finance and healthcare. Theta Lake’s integration with Workvivo addresses these concerns, allowing organizations to utilize engaging features while ensuring regulatory compliance. This partnership, following Zoom’s acquisition of Workvivo, offers a unified ecosystem for secure and compliant communications. Key features include automated capture, AI-powered compliance reviews, and efficient search functions. Theta Lake’s technology empowers firms to engage employees effectively while minimizing compliance risks, solidifying its leadership in communication compliance solutions.

Unlocking Embedded Insurance 2.0: The Future of Seamless Coverage Solutions

Embedded insurance is transforming consumer access to protection by integrating coverage into everyday purchases, marking the shift to Embedded Insurance 2.0. This model simplifies claims processes and aims to rebuild trust in an often complex industry. Industry experts discuss its growth potential in sectors like mobility and healthcare, predicting the market could expand from $136.79 billion in 2024 to $210.90 billion by 2025. Key to this evolution is automation, which must maintain a human touch for user reassurance. Partnerships among platforms, insurers, and service providers are crucial for creating seamless ecosystems, while transparency in coverage terms remains essential for consumer trust.

HLPartnership Expands GI Panel: Welcomes Three New Providers to Enhance UK Mortgage Network

HLPartnership (HLP), a leading UK mortgage network, is enhancing its General Insurance (GI) panel by expanding from two to five providers. This change, driven by adviser feedback, introduces new partners: The Source, Uinsure, and 3XD, alongside existing providers LV= and Paymentshield. The expansion aims to offer more comprehensive solutions for mortgage and protection advisers. HLP is committed to supporting advisers with advanced technology and training webinars on new offerings and processes. Propositions Director Matt Brown emphasized that this expansion increases choice and flexibility, ultimately improving consumer outcomes. For more details, visit HLP’s official website.

Nuvo Secures $45M in Funding from Sequoia and Index Ventures to Revolutionize B2B Trade

Nuvo, a network focused on modernizing B2B trade, has raised $45 million in a funding round led by investors including Sequoia Capital and Spark Capital. This investment will help Nuvo transform outdated trading methods by offering a platform for businesses to exchange verified profiles, facilitating faster and more secure transactions. Currently used by over 50,000 businesses, including Great Dane and Fender, Nuvo plans to expand into sectors like Alcohol, Chemicals, and Logistics while enhancing its payment infrastructure and AI systems. CEO Sid Malladi emphasizes the need for innovative technology in the evolving global economy.

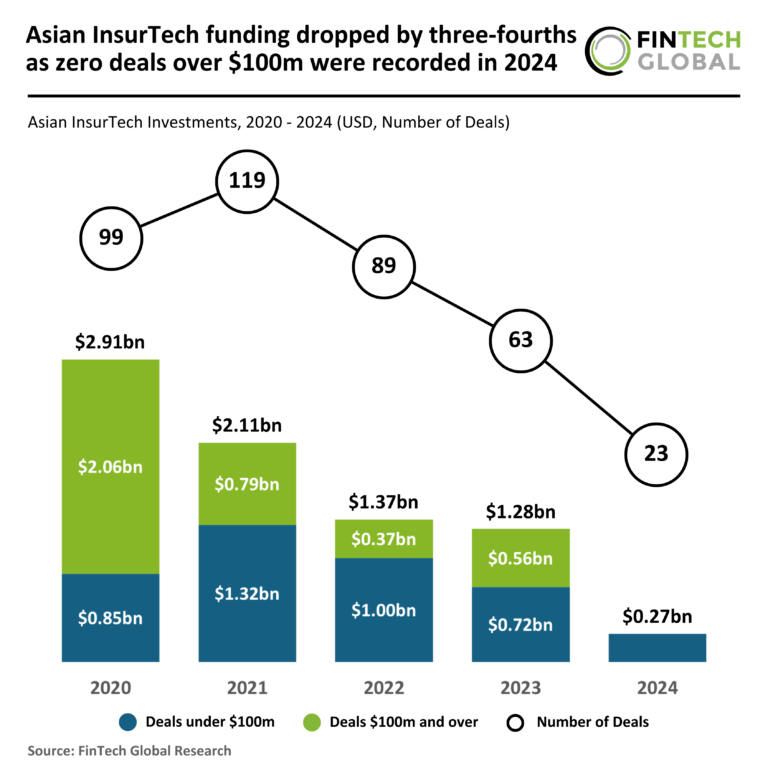

2024 Sees Dramatic 75% Decline in Asian InsurTech Funding with No Deals Exceeding $100M

In 2024, the Asian InsurTech industry experienced a dramatic funding decline, with investments falling 79% to just $269 million, down from $1.3 billion in 2023. The number of deals plummeted to 23, a 63% decrease from the previous year. Notably, no deals exceeding $100 million were recorded. Despite this downturn, Peak3 emerged as a success story, securing a $35 million Series A funding round, the largest InsurTech deal in Asia this year. This funding will support Peak3’s expansion into the EMEA region and enhance its AI-driven insurance solutions, amidst a cautious investment environment.