Similar Posts

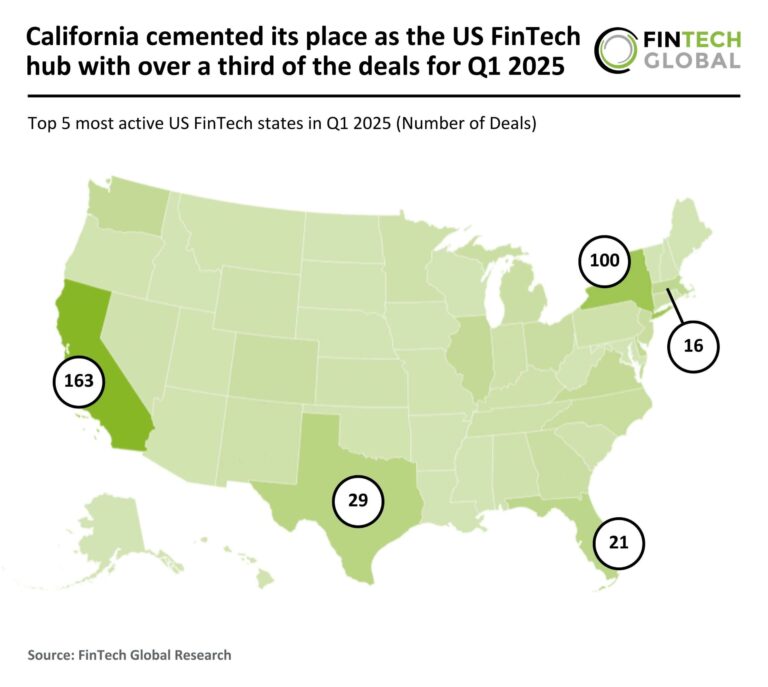

California Reigns Supreme as the US FinTech Hub, Capturing Over 33% of Q1 2025 Investment Deals

In Q1 2025, the US FinTech sector experienced a significant downturn, with deal activity dropping 58% and total funding decreasing to $9.6 billion, a 54% decline from Q1 2024. California remained the leading FinTech hub, accounting for 36% of deals despite a 52% reduction, while New York and Texas also saw declines. Notably, Mercury Financial secured a $300 million funding round led by Sequoia Capital, highlighting ongoing investment interest in innovative banking solutions for startups. This trend reflects a cautious investor approach amid macroeconomic challenges, suggesting a shift in resource allocation within the FinTech industry.

EU Initiative: Transforming Sustainable Finance Framework for a Greener Future

The Platform on Sustainable Finance (PSF) has released a draft report proposing major revisions to the EU Taxonomy to enhance sustainable finance across Europe. This initiative, led by the European Commission, aims to simplify the classification of sustainable economic activities contributing to six environmental objectives, including climate change mitigation and biodiversity protection. Responding to stakeholder feedback, the PSF suggests making the “do no significant harm” (DNSH) criteria more accessible and expanding the Taxonomy to include sectors like digital services and critical metals mining. Chair Helena Viñes Fiestas emphasized improving usability and effectiveness to align more activities with sustainable practices, supporting the EU’s environmental goals.

2025 Reporting Updates: Key IRS Deadlines and FATCA Changes You Need to Know!

The IRS has announced important updates for financial institutions to comply with by January 2025 to avoid penalties. Key deadlines include distributing Form 1099 copies by January 31, 2025, with paper filings due by February 28 and electronic submissions by March 31. Late penalties have increased, reaching up to $660 for intentional non-compliance. Additionally, the Cayman Islands has launched a CRS compliance review, while Finland and France urge timely FATCA and CRS report submissions. Global updates include new reporting jurisdictions in South Korea and changes in Switzerland’s CRS submission deadlines. Financial institutions must enhance compliance processes accordingly.

Revolutionizing Core Banking Migrations: 10x Banking and DLT Apps Join Forces with AI Innovation

10x Banking has partnered with DLT Apps to enhance data migration processes for financial institutions transitioning from legacy systems to modern core banking platforms. This collaboration utilizes advanced AI tools to improve data integrity and ensure seamless migration. By integrating 10x Banking’s migration capabilities with DLT Apps’ TerraAi, banks can expect more efficient strategies. Key features include cloud-native technology for security and scalability, cost-effective solutions, and proven success with institutions like Chase Bank. The partnership aims to uphold data quality and integrity throughout migrations, enabling banks to manage risks and accelerate processes effectively.

ING Unveils ‘Check the Call’ Anti-Fraud Tool in Belgium to Fight Impersonation Scams

ING, a leading Dutch bank, is enhancing fraud prevention in Belgium with the launch of the ‘check the call’ feature, designed to combat helpdesk fraud where criminals impersonate bank staff. Following its success in the Netherlands, this tool allows customers to verify incoming calls via the bank’s mobile app, increasing awareness and confidence in handling potential scams. Statistics reveal that 61% of Belgians have faced attempted fraud, with 40% incurring financial losses. ING’s CEO, Peter Adams, emphasized the need for such protective measures, as the bank remains committed to customer security across Europe.