Similar Posts

SiriusPoint Teams Up with Holmes Murphy to Enhance Captive Insurance Solutions

SiriusPoint has partnered with Holmes Murphy, a leading independent U.S. insurance brokerage, to create a tailored umbrella excess insurance product for captives managed by Holmes Murphy and its subsidiaries. SiriusPoint will serve as the carrier partner, underwriting this innovative solution on a non-admitted basis. The collaboration aims to enhance risk management as the captive insurance market grows. Holmes Murphy’s Innovative Program Solutions (IPS) will leverage this partnership to offer customized coverage, addressing the rising costs of insurance. Both companies emphasize the importance of expert collaboration in meeting the increasing demand for effective risk solutions.

Altruist Raises $152M in Series F Funding to Accelerate Growth of WealthTech RIA Platform

Altruist, a technology-driven firm for independent registered investment advisors (RIAs), has raised $152 million in a Series F funding round led by Singapore’s GIC and other notable investors, boosting its valuation to approximately $1.9 billion. The firm offers a fully integrated custodian platform with tools for account management, trading, and reporting, enabling advisors to effectively manage client portfolios. In 2024, Altruist launched new products, including high-yield cash accounts and tax management tools, driving significant growth and tripling its assets under management. This funding strengthens Altruist’s mission to democratize financial advice and enhance the advisor-client relationship.

Transforming Wealth Management in 2025: The Impact of AI, Transparency, and Gen Z

In 2025, the wealth management sector is transforming due to global economic shifts, technological advancements, and changing investor expectations. Key trends include the impact of the evolving political landscape, demographic changes with younger populations in some regions, and the integration of AI for personalized client interactions and improved efficiency. Gen Z investors are influencing firms to prioritize sustainability and use digital platforms for engagement. Additionally, there is a growing demand for transparency in fund management and ESG disclosures. Firms that adapt to these trends will be better positioned to succeed in this complex environment.

Convex Group Secures Green Light for Launch of Lloyd’s Syndicate 1984

Convex, a prominent specialty insurer and reinsurer, has received in-principle approval to establish Lloyd’s Syndicate 1984, aiming to enhance its global presence and capture opportunities in the Lloyd’s market. The syndicate plans to generate £150 million in gross written premiums by 2025, focusing on sectors such as Accident & Health, Casualty, and Marine. Jacqueline Wiffen will lead the syndicate, supported by partnerships with Gallagher Re and Asta. CEO Paul Brand expressed optimism about this venture, reinforcing Convex’s commitment to expanding its business. Industry leaders have welcomed Convex’s entry into the Lloyd’s market, praising its underwriting expertise.

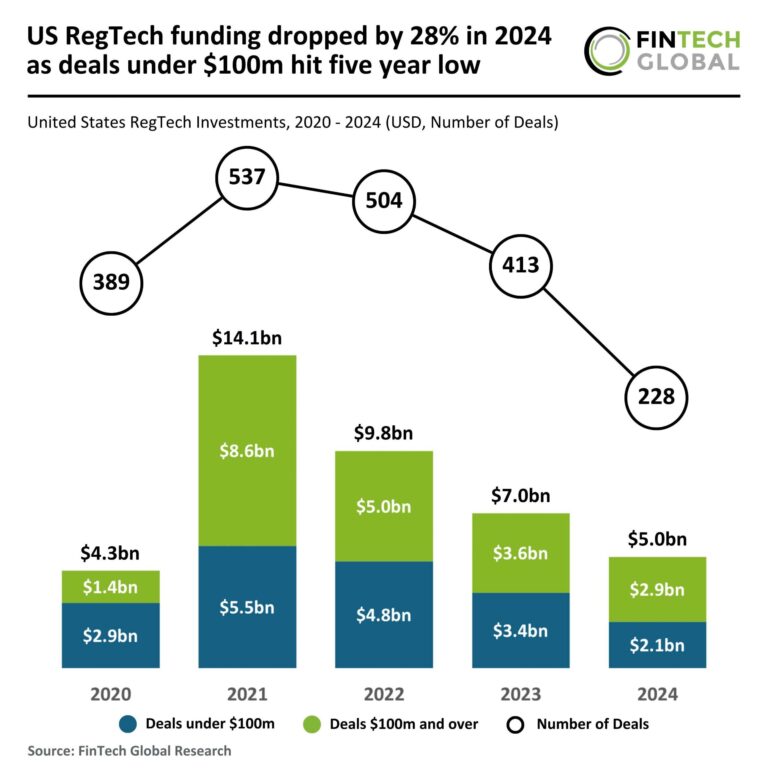

US RegTech Funding Plummets 28% in 2024: Deals Under $100M Reach Five-Year Low

In 2024, the US RegTech investment landscape saw a significant decline, with total funding dropping 28% to $5 billion and deal volume decreasing 45% to 228. Smaller deals under $100 million fell to $2.1 billion, the lowest in five years, while larger deals remained more stable, totaling $2.9 billion. Amid this downturn, Norm AI stood out, securing a $27 million Series A funding round led by Coatue, with additional investments from firms like Bain Capital Ventures. Norm AI specializes in AI-driven regulatory compliance, dramatically improving efficiency for major corporations.

Unlocking AML in Real Estate: The Ultimate Guide for Estate Agents and Homebuyers

Buying a home in the UK involves navigating complex legal requirements, particularly anti-money laundering (AML) checks, which typically take five days to two weeks. The timeline depends on timely document submission and the need for Enhanced Due Diligence. Buyers should prepare identification, address verification, and proof of funds in advance. Estate agents play a crucial role in AML compliance by verifying identities and conducting funds checks. Delays may arise from foreign funds or anonymous buyers, necessitating deeper investigations. Compliance with AML regulations is vital for economic stability, with significant penalties for non-compliance, as seen with fines imposed on 144 estate agents recently.