Similar Posts

Pikl Strengthens Leadership Team to Accelerate InsurTech Growth and Innovation

Pikl, a leading InsurTech company in vacation rental insurance, has strengthened its leadership team with the appointments of Steve McGuinness as COO and James Everett as CUO, aiming to boost growth after launching B2B services in 2023. McGuinness, with experience from major insurers, will enhance operational capabilities, while Everett will focus on underwriting strategies. CEO Louise Birritteri expressed excitement about the new appointments, highlighting their alignment with Pikl’s ambitious growth strategy. The company is poised to capitalize on the rising demand for specialized insurance products in the vacation rental market as it continues to innovate and expand.

Transforming InsurTech: How Evolving Customer Needs Will Shape the Industry in 2025

In 2025, the InsurTech landscape will undergo a major transformation driven by changing consumer expectations for instant services, personalized insurance, and seamless online experiences. Insurers are adopting advanced technologies, including AI and automation, to enhance customer interactions and streamline processes. Key trends include the rise of instant services, hyper-personalized policies, and the integration of AI-driven assistants. Insurers must also navigate regulatory pressures and a growing focus on sustainability. Industry experts, including leaders from Simplifai and Ushur, emphasize the importance of innovative customer engagement strategies that balance efficiency and personal connection in this evolving market.

Mastercard and Cairo Amman Bank Join Forces to Transform Cross-Border Payments in Jordan

Mastercard has partnered with Cairo Amman Bank to enhance cross-border money transfers for Jordanian customers, enabling seamless transactions to 37 countries. This collaboration aims to improve financial inclusion and modernize Jordan’s financial sector. Utilizing Mastercard’s Move platform, the partnership will facilitate quick and secure transfers while offering tailored services such as fraud analytics. With Jordan’s remittance value reaching $4.94 billion in 2023, this initiative addresses challenges in cross-border payments, fostering a more accessible digital economy. Both companies’ leaders emphasize the importance of this partnership in enhancing payment capabilities and supporting local businesses and consumers in the global market.

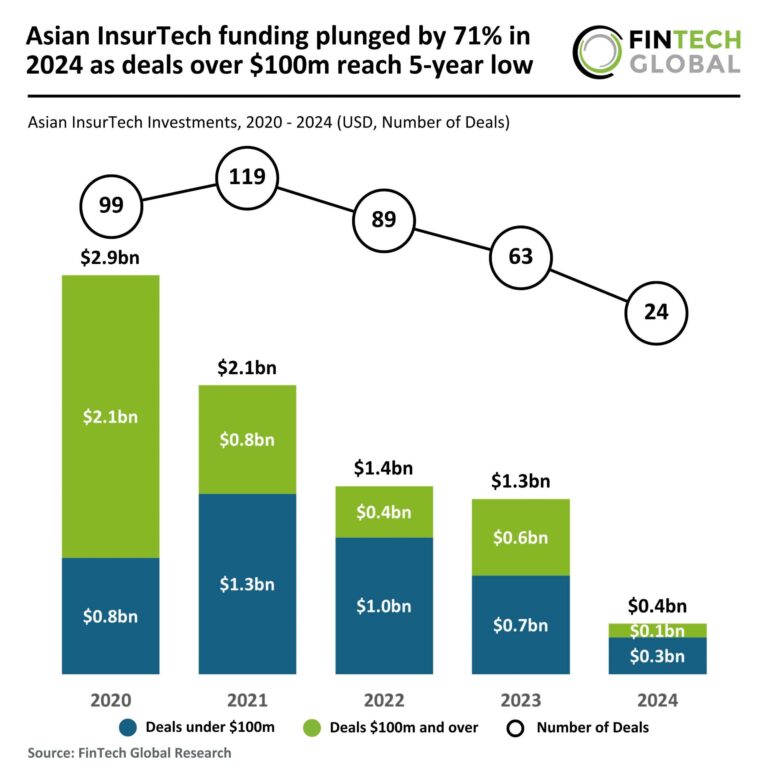

2024 Sees 71% Drop in Asian InsurTech Funding: Deals Over $100M Hit 5-Year Low

In 2024, the Asian InsurTech sector faced a drastic downturn, with funding plummeting by 71% to $369 million, down from $1.3 billion in 2023. The number of deals also dropped by 63%, totaling just 23, while the average deal size declined by 21% to $16 million. High-value deals fell to a five-year low, with only $100 million raised, reflecting increased investor caution. Despite this, bolttech secured the largest funding round of the year, raising over $100 million in its Series C, aiming to enhance its platform and expand globally. The landscape remains challenging for stakeholders navigating these trends.

Transforming the UK Insurance Landscape: The Impact of BIBA’s Advocacy Efforts

The BIBA 2025 Manifesto, launched by FullCircl, underscores the vital role of insurance in bolstering the UK economy and addressing protection gaps, particularly in flooding and cyber risks. CEO Graeme Trudgill highlights the diverse opportunities in insurance broking and its importance in risk management across various industries. The manifesto also tackles regulatory challenges, advocating for “Chartered” status to enhance professional standards and collaboration with the Chartered Insurance Institute. BIBA seeks adjustments from the FCA regarding burdensome regulations and promotes the commission model for consumer access to expert advice. The manifesto calls for innovation and a reduction in Insurance Premium Tax to strengthen the sector.

Climate FinTech Bees & Bears Secures €500M to Accelerate Household Energy Transition

Bees & Bears, a climate FinTech company, has secured €500 million in financing to promote sustainable energy solutions in Germany, enabling the installation of nearly 25,000 energy-efficient systems like photovoltaic systems, heat pumps, and energy storage systems. Funded by a reputable bank and overseen by the European Central Bank, the initiative aims to reduce carbon footprints and enhance renewable energy adoption. The company offers flexible installment payment options for homeowners and collaborates with local tradesmen to ensure expert service. Their streamlined financing process includes quick credit checks and a user-friendly experience, supporting the transition to energy independence and combating climate change.