Similar Posts

Hong Kong Investment Firm Chooses MCO for Superior Compliance Management Solutions

A Hong Kong-based investment management firm has partnered with MyComplianceOffice (MCO) to enhance compliance processes in line with Securities and Futures Commission regulations. By implementing MCO’s Know Your Employee (KYE) suite, the firm will replace outdated manual workflows, improving operational efficiency and reducing compliance risks. MCO was chosen for its comprehensive compliance management tools, regional expertise, and responsive service. The collaboration, led by MCO’s APAC Sales Director and the firm’s Chief Compliance Officer, will utilize MCO’s KYE solutions, including Personal Trading Manager and OCR Trade Capture. This partnership underscores the importance of advanced compliance frameworks in the investment sector.

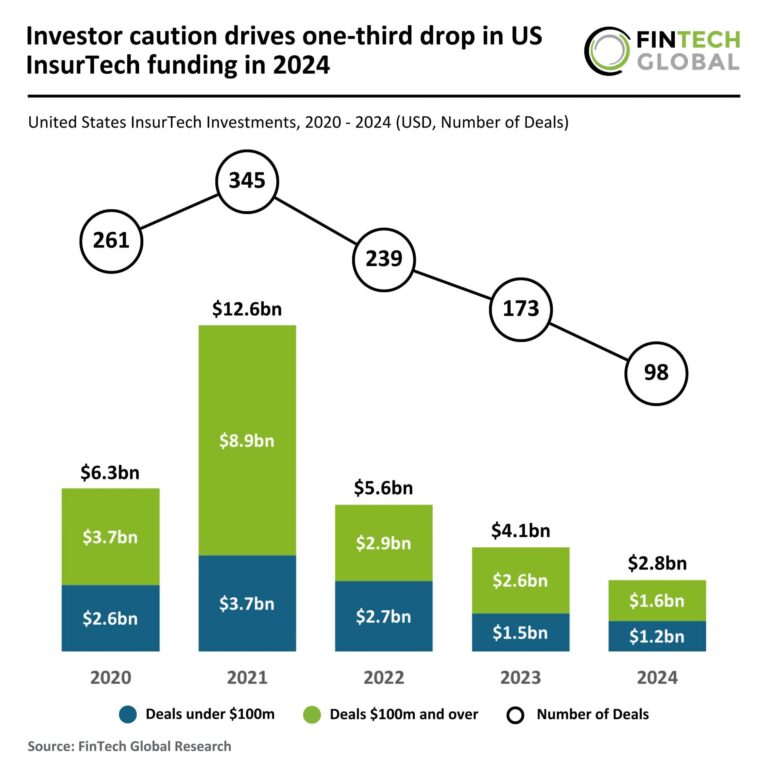

US InsurTech Funding Plummets 33% in 2024 Amid Investor Caution

In 2024, the US InsurTech sector experienced a significant decline in funding, dropping to $2.8 billion across 98 deals, a 33% decrease from 2023 and 56% from 2020. Deal activity also fell sharply, with a 43% reduction in transactions compared to the previous year. Investor caution is evident, particularly in large deals over $100 million, which decreased by 38%. Despite this, the average deal value rose to $28.1 million. Notably, Cowbell, a cyber insurance provider, secured a $60 million Series C round to enhance its AI-driven technology and expand internationally, positioning itself as a key player in the market.

MIB Group Boosts Underwriting with Clareto Acquisition from Munich Re for Enhanced Electronic Health Record Integration

MIB Group has acquired Clareto, a medical record retrieval company, from Munich Re Life US to enhance its electronic health records (EHR) capabilities for life insurance underwriting. This acquisition aims to improve data access and analytics, facilitating more automated risk assessments. Although financial details were not disclosed, integrating Clareto’s expertise into MIB’s EHR platform will provide broader access to medical data and improve the underwriting process. Leaders from both MIB and Munich Re emphasized the partnership’s potential to streamline underwriting data acquisition, accelerate decision-making, and enhance customer satisfaction within the life insurance sector.

Tines Secures $125M Funding to Supercharge AI-Driven Workflow Innovations

Tines, an AI-powered workflow automation company, raised $125 million in its Series C funding round, boosting its valuation to $1.125 billion. Led by Goldman Sachs Alternatives, the funding included new investors like SoftBank Vision Fund 2 and Activant, alongside existing backers such as Accel and Felicis. Founded in 2018, Tines aids organizations in managing workflows to enhance security and productivity, with over one billion automated tasks executed weekly. The funding will support AI-driven product development, including a new generative AI chat interface, Workbench. CEO Eoin Hinchy aims to alleviate the burdens on IT and security teams through innovative automation solutions.

Triglav Partners with Munich Re to Enhance Underwriting with Advanced SaaS Automation Solutions

Munich Re Automation Solutions has launched the ALLFINANZ SPARK, a cloud-based Software-as-a-Service (SaaS) underwriting platform, now adopted by Slovenia’s leading insurer, Triglav. This transition aims to improve operational efficiency and responsiveness to market changes. Key benefits of the platform include streamlined workflows, enhanced agility, high security standards, and advanced analytics for better decision-making. Features such as a flexible rules engine, third-party data integration, and support for real-time and manual assessments optimize the underwriting process. Triglav and Munich Re have partnered since 2018, enhancing insurance solutions in Slovenia and solidifying their competitive edge in the market.

Latin America’s Mendel Raises $35M Series B to Revolutionize AI-Powered Spend Management

Mendel, a top enterprise spend management platform in Latin America, has raised $35 million in a Series B funding round led by Base10 Partners, with contributions from PayPal Ventures and other investors. This funding will help Mendel enhance its AI-driven capabilities and expand into Chile, Colombia, Peru, and Brazil by 2026. The company uses a software-first model to help businesses manage expenses and travel efficiently, focusing on recurring SaaS fees rather than interchange revenue. With a strong presence in Mexico and Argentina, Mendel serves major clients like Mercado Libre and McDonald’s, aiming to revolutionize financial management in the region.