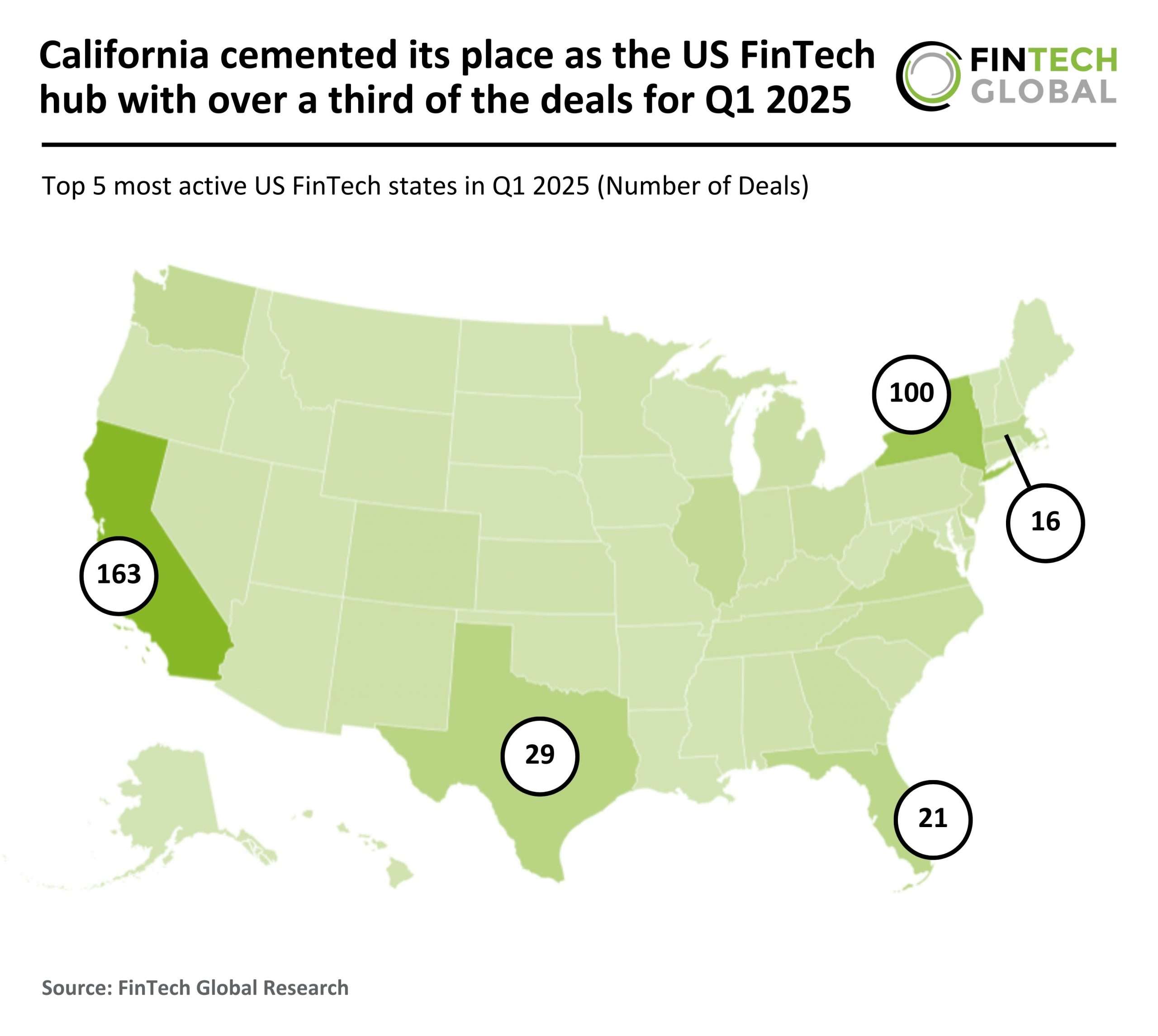

California Reigns Supreme as the US FinTech Hub, Capturing Over 33% of Q1 2025 Investment Deals

In the first quarter of 2025, the US FinTech sector faced a significant downturn, with a notable 58% drop in deal activity compared to the previous quarter. This decline raises important questions about the current state of investments in the financial technology industry.

Significant Decline in US FinTech Investment Activity

During Q1 2025, the US FinTech market saw a drastic reduction in both funding and deal activity. The total funding plummeted to $9.6 billion, reflecting a 54% decrease from the $20.8 billion raised in Q1 2024. Additionally, the number of completed transactions fell to only 458, marking a 58% drop from the 1,081 deals recorded in the same quarter of the previous year. This trend indicates a cautious approach from investors amid ongoing macroeconomic challenges.

California Remains the FinTech Hub

Despite the overall decline, California solidified its status as the leading hub for FinTech in the US, accounting for over a third of the total deals.

- California recorded 163 deals (36% share), though this was a 52% drop from 342 deals in Q1 2024.

- New York followed with 100 deals (22% share), a 39% decline from 163 deals.

- Texas completed 29 deals (6% share), reflecting a 55% decrease from 65 deals in the same quarter of the previous year.

Despite fewer deals, the concentration of investment activity suggests that funding is increasingly focused within major financial hubs, indicating a potential shift in how resources are allocated in the FinTech sector.

Major FinTech Deal of the Quarter: Mercury Financial

Among the significant transactions, Mercury Financial, a prominent provider of banking solutions for tech startups, secured one of the largest deals in Q1 2025 with a $300 million funding round. This round was led by Sequoia Capital Management LP, along with partners such as Spark Capital, Marathon Asset Management LP, Coatue Management, Charles River Ventures, and Andreessen Horowitz.

This investment demonstrates a strong belief in Mercury’s innovative banking solutions tailored for startups, which include:

- Business checking and savings accounts

- International wire transfers

- Advanced financial tools, including cash flow analytics and customizable dashboards

The new capital will be pivotal for Mercury’s product development, team expansion, and potential acquisitions, further cementing its role as a significant player in the evolving FinTech landscape. Additionally, its venture debt financing initiative launched in 2022 provides startups with alternative funding options, while improvements in invoicing and receipt management enhance operational efficiency.

As the FinTech industry continues to navigate these challenges, staying informed about market trends and investment opportunities will be critical for stakeholders.