OpenFX Secures $23M Funding to Revolutionize Global FX Settlement in FinTech

OpenFX, an innovative FinTech company committed to revolutionizing the global financial landscape, has recently announced its launch following a successful funding round of $23 million. Founded by the seasoned entrepreneur Prabhakar Reddy, OpenFX focuses on enhancing cross-border payments through cutting-edge real-time foreign exchange (FX) settlement capabilities.

Funding Milestone for OpenFX

The initial funding round, led by Accel and joined by notable investors including NFX, Lightspeed Faction, Castle Island Ventures, Flybridge, and Hash3, showcases robust confidence in OpenFX’s objective to address the inefficiencies prevalent in the $200 trillion annual FX market.

Transforming Cross-Border Payments

OpenFX is on a mission to create a real-time, open FX network that significantly reduces both the cost and time associated with international transactions. Key features of their platform include:

- Near-Instant FX Settlement: Transactions are settled continuously, independent of banking hours.

- Speed and Cost Efficiency: OpenFX claims its services are 99% faster and up to 90% cheaper compared to traditional providers.

Expansion Plans and Infrastructure Development

With the newly acquired funding, OpenFX aims to:

- Expand its platform into Latin America and Asia.

- Broaden its regulatory reach.

- Introduce new treasury management solutions.

Currently, OpenFX efficiently settles 90% of its transactions in under one hour, far exceeding the typical 2 to 7 days seen in the industry.

Rapid Growth and Adoption

In just one year, OpenFX has experienced remarkable growth, achieving an annualized transaction volume of $10 billion. The platform has been embraced by various financial entities, including remittance firms, neobanks, brokerages, and global payroll providers. Notably, one client reached $100 million in transaction volume a mere 17 days after integration.

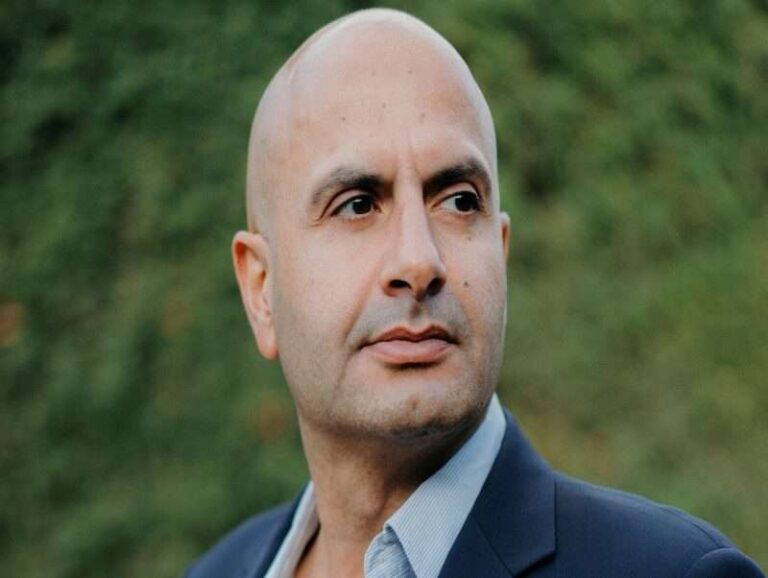

Leadership with Industry Expertise

The leadership team at OpenFX comprises professionals from prestigious organizations such as PayPal, Slack, Kraken, Affirm, JP Morgan, and Microsoft. This diverse expertise supports OpenFX’s ambition to become a pivotal infrastructure provider for cross-border payments in an increasingly AI-driven economy.

Vision for the Future

Prabhakar Reddy, CEO of OpenFX, states, “The $200 trillion annual FX market is still operating on outdated infrastructure from the 1970s. Our goal is to construct the essential settlement framework for an AI-centric economy, enabling money to move as freely as data, unrestricted by time zones or legacy systems.”

As OpenFX embarks on this exciting journey, industry experts, including Accel partner Shekhar Kirani, believe that OpenFX could evolve into the AWS of global finance, providing secure and trusted infrastructure that empowers developers and businesses to reshape cross-border commerce.

This marks OpenFX’s inaugural public funding round and signifies a crucial milestone in its growth trajectory since its discreet launch in early 2024.

For more information on financial technologies, visit our FinTech section.