Transforming Finance: 83% of Firms Embrace Generative AI with Plaid Pioneering IDV Innovation

In a bid to enhance security measures against fraud in the financial sector, Plaid has launched significant upgrades to its identity verification (IDV) product. These enhancements are particularly timely given the rise of generative AI-enabled fraud tactics. As detailed in a recent blog post, Plaid’s updated IDV solution includes advanced tools aimed at detecting deepfakes, recognizing synthetic media, and identifying facial duplicates.

New Features in Plaid’s Identity Verification Solution

The latest upgrades to Plaid’s IDV product, announced on May 13, include:

- Deepfake Detection: New tools to identify manipulated media.

- Synthetic Media Recognition: Ability to flag synthetic identities.

- Facial Duplicate Identification: Enhanced scrutiny for potential impersonation.

- Age Estimation: Helps in detecting impersonation attempts.

- Adaptive Verification Flows: Real-time adjustments to identity checks based on risk assessment.

These features aim to streamline the verification process for low-risk users while providing additional layers of scrutiny for high-risk individuals. Notably, existing customers can access these upgrades immediately without needing to integrate new systems.

The Growing Threat of AI-Enabled Fraud

As financial institutions increasingly adopt AI technologies, the threat from fraudsters has also escalated. According to Plaid’s product marketing manager, Danica Kleint, and product manager, Anthony Sezer, “New generative AI models are emerging weekly, enabling even novice fraudsters to create convincing fake ID verification sessions.” This rapid evolution underscores the importance of implementing a defense-in-depth strategy, which involves layering multiple independent checks to mitigate risks effectively.

Industry Trends and Implications

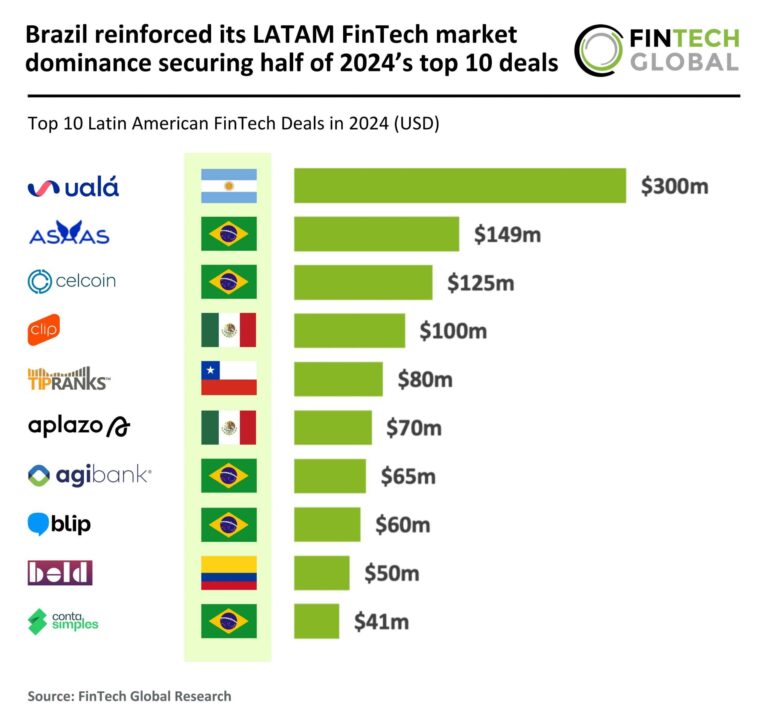

The need for robust identity verification tools is emphasized by recent findings from a PYMNTS Intelligence report, which indicates that 83% of financial institutions are exploring generative AI for strengthening fraud defenses. While AI can facilitate fraudulent activities, it is also being utilized to uncover subtle fraud patterns that might otherwise go undetected.

Plaid’s Response to Evolving Fraud Landscape

Plaid’s recent enhancements reflect the growing demand for advanced digital identity solutions. The company reported a remarkable surge of over 400% in the usage of its IDV product in 2024. This increase highlights the urgent need for firms to safeguard their onboarding and transaction processes. Additionally, Plaid secured a $575 million funding round to expand its offerings, particularly in fraud prevention and payment infrastructure.

Conclusion

Plaid is transitioning from a company focused solely on bank linking to a comprehensive suite of data analytics products that play a crucial role in financial services and related markets. As co-founder and CEO Zach Perrett stated, “Whether it’s signing up new users, fighting fraud, enabling bank payments, or making underwriting decisions, our network is core to the way our customers run their businesses and consumers manage their financial lives.”

For further details, you can find the full story on RegTech Analyst.