UK WealthTech Dominance: Securing Half of Q1 2025 European Investment Deals

The European WealthTech market is experiencing significant shifts, particularly evident in the first quarter of 2025. With a dramatic drop in deal activity and funding, it is crucial for stakeholders to understand the emerging trends and implications within this dynamic landscape.

Q1 2025 European WealthTech Investment Overview

In the first quarter of 2025, the European WealthTech sector witnessed a staggering 85% decline in deal activity compared to the previous quarter. This downturn signals a cautious investor sentiment and heightened scrutiny in the WealthTech space.

Funding and Deal Activity Decline

The total funding for WealthTech companies in Europe plummeted to $418 million, marking an 82% decrease from the $2.3 billion raised in Q1 2024. The number of completed deals also fell from 163 to just 24 in the same time frame. This contraction underscores a broader trend of reduced investor interest amid ongoing economic challenges.

UK Dominates European WealthTech Landscape

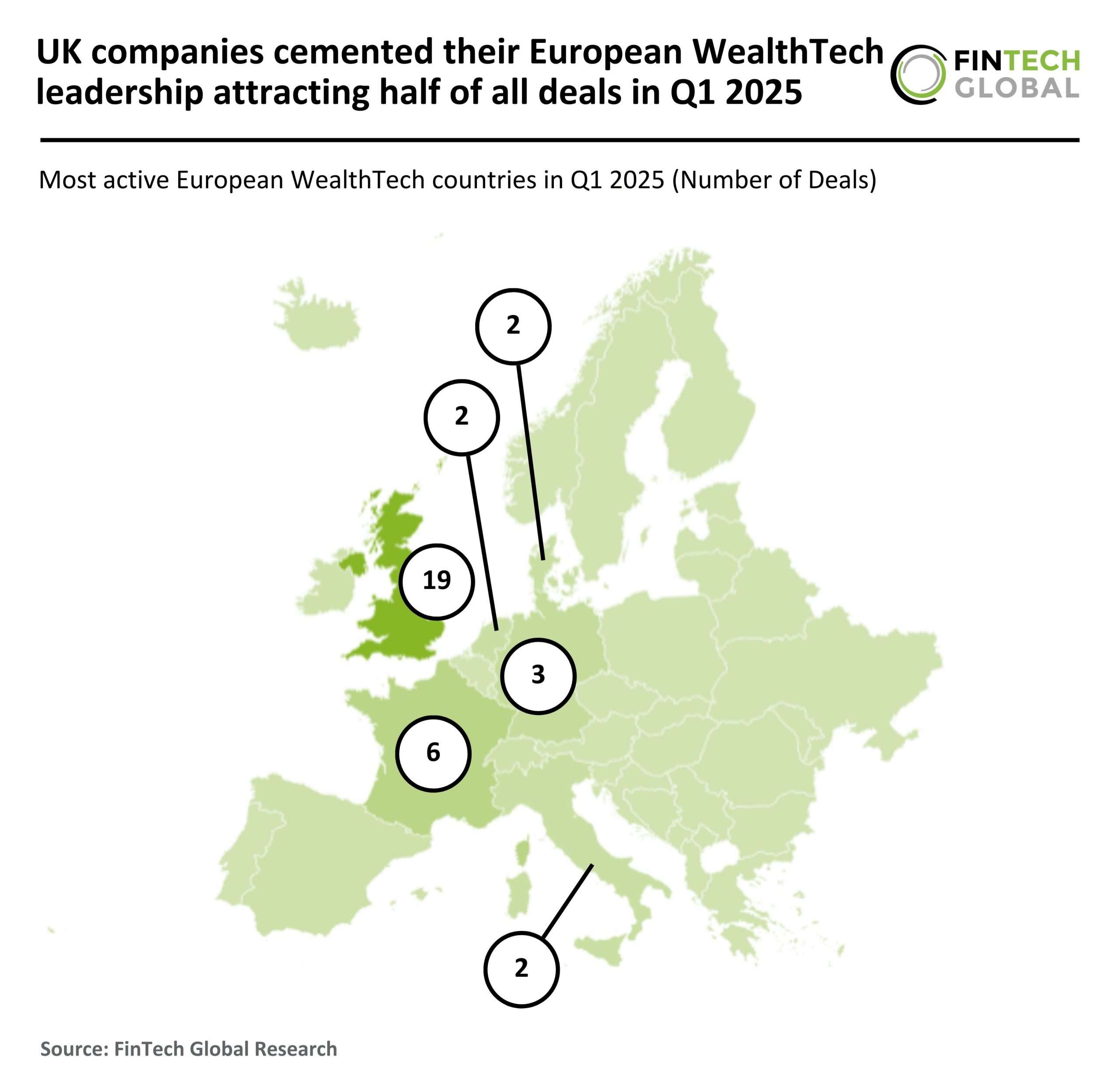

The United Kingdom has solidified its position as a leader in the European WealthTech market, accounting for 51% of all deals in Q1 2025. Here are some key statistics:

- 19 deals completed by UK companies, down from 62 in Q1 2024.

- France followed with 6 deals, holding a 16% market share.

- Germany faced a substantial drop, completing only 3 deals, down from 35 last year.

This shift indicates a growing dominance of UK firms in cross-border WealthTech engagements, while other regions face relative declines.

Fundment Secures Major Series C Funding

Among the most notable developments in the European WealthTech sector is the $55.5 million Series C funding round secured by Fundment, a UK-based technology platform. This funding, led by Highland Europe and ETFS Capital, is pivotal for transforming wealth management by streamlining administrative processes for financial advisers.

Impact of Fundment’s Technology

Fundment’s innovative platform aims to replace outdated and fragmented infrastructure, providing:

- Integrated core services and back-office tools.

- Discretionary investment management capabilities.

- Support for tax wrappers and custom API integrations.

This technology addresses the growing need for timely, data-driven client interactions, positioning Fundment to benefit from the anticipated $68 trillion in assets expected to be transferred globally over the next 30 years. The platform is already integrated with major financial institutions such as Legal & General, BlackRock, and HSBC, supporting various investment vehicles.

As the WealthTech landscape continues to evolve, stakeholders must adapt to these market shifts and leverage emerging opportunities for growth and innovation.